The European Central Bank once again doubled down on their belief that Bitcoin is doomed. What else could we expect from one of the central banks that control the current monetary system? We believe that this occurrence provides an outstanding opportunity to refresh our minds on the current monetary system, how it works, who and how controls the strings, as well as how we got here and potential future changes. Since covering all of it in a single blog would be way too extensive, we’ll break it into two parts.

The first part, which will be covered today, will cover the history of money. How did money develop from the barter system? Why were gold and silver used as money? What is the gold standard? And, last but not least, how did we end up with the fiat standard? All of these questions will be answered, along with lots of emphasis on the gold standard which was used widely for thousands of years, until it gradually disappeared in the 20th century. The era of at least having the value of reserve currency (dollar) pegged to gold ‘temporarily’ ended in the 1970s, when president Nixon closed the gold window. This meant that the government isn’t required to hold a certain amount of gold in reserve to back the value of its currency anymore. Instead, in the fiat system the value of the currency is determined by market forces and only backed by the government's promise to pay.

Meanwhile, the second part (which will be released next week) will cover what the future could potentially bring about with the rise of digital currencies. It has led to speculation about the potential emergence of a Bitcoin standard, in which a country's currency would be pegged to the value of Bitcoin. This would be a new type of monetary system, which could combine the flexibility of a fiat standard with the security and transparency of a decentralized digital currency in case it turned out to be just a merger between the current fiat system and blockchain technology. Some people go even further, calling for a totally decentralized monetary system that would operate completely without government involvement (note that Central Bank Digital Currencies don’t help with the core issues of the current system at all - in fact, they might even make them worse).

All these different ideas of a Bitcoin standard are still in their early stages, nevertheless, they offer a potentially revolutionary change in the way money gets created and used in comparison to the system we have today. In a way it resembles commodity standards from the past (such as gold or silver standard), which kept the government fiscally responsible. Therefore make sure you don’t miss next week’s article, as it is surely going to cover topics you as a crypto enthusiast will find very interesting. However, today’s quick overview of history and how we ended up with the monetary system that is in place today, represents a necessary introduction for the potential Bitcoin standard that will be covered next week. As you probably already know, understanding history can be very helpful if you want to predict the future. So, let’s dive right into it!

What is money and how has it evolved?

There are three main properties that define money. It needs to serve as a medium of exchange, a unit of account, and a store of value. When it comes to a medium of exchange, it refers to its ability to be used to buy and sell goods and services. Money allows people to trade without having to engage in the cumbersome and inefficient process of barter. The unit of account property indicates that it is used to measure the value of goods and services. This allows people to compare the relative value of different items and make decisions about what to buy and sell. Additionally, money must also act as a store of value (maintain its value throughout time), so it can be saved and used at a later time to purchase goods and services and allow people to accumulate wealth.

Money has been a crucial part of human society for thousands of years, despite the fact that its form and function have evolved over time. In the early days of human civilization, people relied on a system of barter, in which goods and services were traded directly for other goods and services. This system was limited by the fact that people had to find someone who was willing and able to trade the specific goods or services that they had for the ones that they needed. To overcome this limitation, people began to use a variety of objects as money. Everything from stones, shells, tobacco leaves to sugar has been used as a medium of exchange.

Why did gold and silver play the role of money in a majority of past societies?

Historically, gold and silver have emerged as widely accepted money in a free market. Why? Because they both meet three basic standards of money. Both precious metals are easily divisible, transportable and non-perishable, which makes them the perfect medium of exchange. Additionally gold (or silver) is very useful as a unit of account for two reasons. Firstly, gold has for a long time been desired for its beauty, use and scarcity, which makes it intrinsically valuable. Secondly, gold is relatively stable in value, which means that it retains its purchasing power over time. This makes it a useful tool for measuring the value of other goods and services. On top of it, the second characteristic makes both metals a good store of value, as it gives people an ability to accumulate wealth. This is particularly obvious when you take into account that gold is uniquely durable (it doesn’t corrode or deteriorate over time) and easy to store (it is a dense metal, which allows you to store large quantities of gold - lots of value, in a relatively small area).

How did we end up with paper money?

The transition from using gold as a medium of exchange to using paper money occurred gradually over time. In the early days of the gold standard, people used gold bars and coins to settle transactions. However, as trade and commerce expanded, the use of gold coins became more and more impractical, since they were heavy and difficult to transport. On top of that, carrying around huge amounts of gold also greatly increases the risk of getting robbed. To overcome these limitations, more and more people began to use paper receipts or certificates that were issued by goldsmiths as money.

What were these certificates? Simply put, when people deposited their gold at goldsmiths, they would get a gold receipt (certificate). These receipts included information on how much gold was deposited at a particular goldsmith and allowed the depositor to get back their gold on demand with a receipt. Consequently these receipts started being used as a means of exchange. Instead of settling transactions with gold, people exchanged goods and services for these receipts, as they served as a convenient and easily transportable substitute for gold. Keep in mind though that these receipts were easily redeemable for gold, which means that gold was still money, while these receipts acted as a currency. In the United States, goldsmith receipts began to be used as a form of money in the late 18th and early 19th centuries, as the country was establishing its financial system and developing its economy. Over time, these receipts came to be known as dollars.

When did things stray off course?

Unfortunately these goldsmiths, which we’ll from now on call bankers, as banks and bankers evolved from goldsmiths, were smart enough to realize they could issue more receipts (notes) than they held gold reserves in order to drive up their profits. They created a system, which is today known as fractional reserve banking, where the amount of money banks lended out isn’t fully covered with gold they had at their vault. Now, these bankers weren’t merely storing gold for a fee, but were also artificially inflating the money supply, which resulted in numerous ‘booms’ followed by ‘busts' when either the money supply stopped inflating, or when too many people showed up at bank to withdraw their gold and there wasn’t enough gold in the vault to meet the demand.

Instead of making sure these bankers held enough reserves to meet demand, by punishing banks that practiced fractional reserve banking, the government used an opportunity to create a central bank that acted as a "lender of last resort". This means the central bank was there to provide financial support to any bank if they got into trouble. If they got into liquidity issues, they would get the cash from Washington D.C. What is more, J.P. Morgan, who was the world’s most powerful banker at the time and oil tycoon John D. Rockefeller both wanted cheap credit and an inflated money supply to finance the expansion of their empires. Consequently they both lobbied the U.S. government and together led a campaign to sell the idea of a central bank to the public. Apparently, J.P. Morgan and John D. Rockefeller even helped devise the Central Banking Act, which laid the foundation for the Federal Reserve Act that was written into law in late 1913.

What changes did the establishment of the Federal Reserve bring about?

The most significant change was the creation of a central banking system for the United States, which was responsible for implementing the country's monetary policy and overseeing the banking system. This marked a departure from the decentralized system of banking that had existed in the U.S. prior to the establishment of the Federal Reserve. The Act also granted the Federal Reserve System numerous new powers, including the ability to regulate the money supply and set interest rates, in order to promote the "stability" and "efficiency" of the financial system.

The idea sold to the public was that these changes helped to modernize the U.S. monetary system and make it more resilient to economic shocks, while in reality artificially inflating money supply through credit creation leads to economic booms, which are unsustainable and eventually lead to a crisis. An Austrian economist Ludwig Von Mises was warned about dangers of expanding the money supply in his book "The Theory of Money and Credit" even before the Federal Reserve was created by saying: "There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved".

The beginning of the end?

A little more than 15 years after the passing of the Federal Reserve Act, the US got arguably the worst financial crisis of all time - the Great Depression that lasted from 1929 to 1939. On the grounds of fighting the crisis, the U.S. government suspended the convertibility of dollars into gold in 1933. This meant that the dollar was no longer backed by gold, and its value was subject to fluctuations based on market conditions. Moreover, the government effectively made it illegal to own gold by unconstitutionally requiring American citizens to turn in their gold in exchange for dollars at the fixed price of $35 per ounce.

The paper currency people received in exchange for the gold had always been redeemable for gold in the past, so there was hardly any backlash. Additionally most trusted the government that this was necessary to fight the crisis, only to find out they were never getting their gold back, and that the paper dollars they got in exchange would be devalued. Soon only foreign governments and central banks would be able to convert dollars into gold and even that link to gold eventually ended in 1971.

The beginning of a "temporary" fiat standard

The U.S. completely abolished the gold standard 1971, when then president Richard Nixon announced that the government was only "temporarily" suspending the convertibility of dollars into gold, even for foreign governments and central banks. Ever since, the dollar has been operating as a fiat currency, with its value based solely on the trust and confidence that people have in the U.S. government.

While the gold standard comes with stability and predictability, because the value of a currency is tied to gold, which limits the supply of money and keeps the value of a currency stable, the fiat standard brings about numerous problems. The most obvious one is inflation. Since the supply of fiat money can be increased at will, governments tend to exploit it. Politicians always want to bribe voters with "free" stuff, but unfortunately there is no such thing as a free lunch, so people pay these government programs through erosion of their purchasing power and depletion of their savings pool in real terms (because of the rising prices that occur as a result). These price increases harm everyone, especially the poor and the lower middle class, who have lower income and may have to directly cut their consumption. This can make it difficult for people to afford the things they need, leading to a decrease in demand and economic activity and can result in a recession.

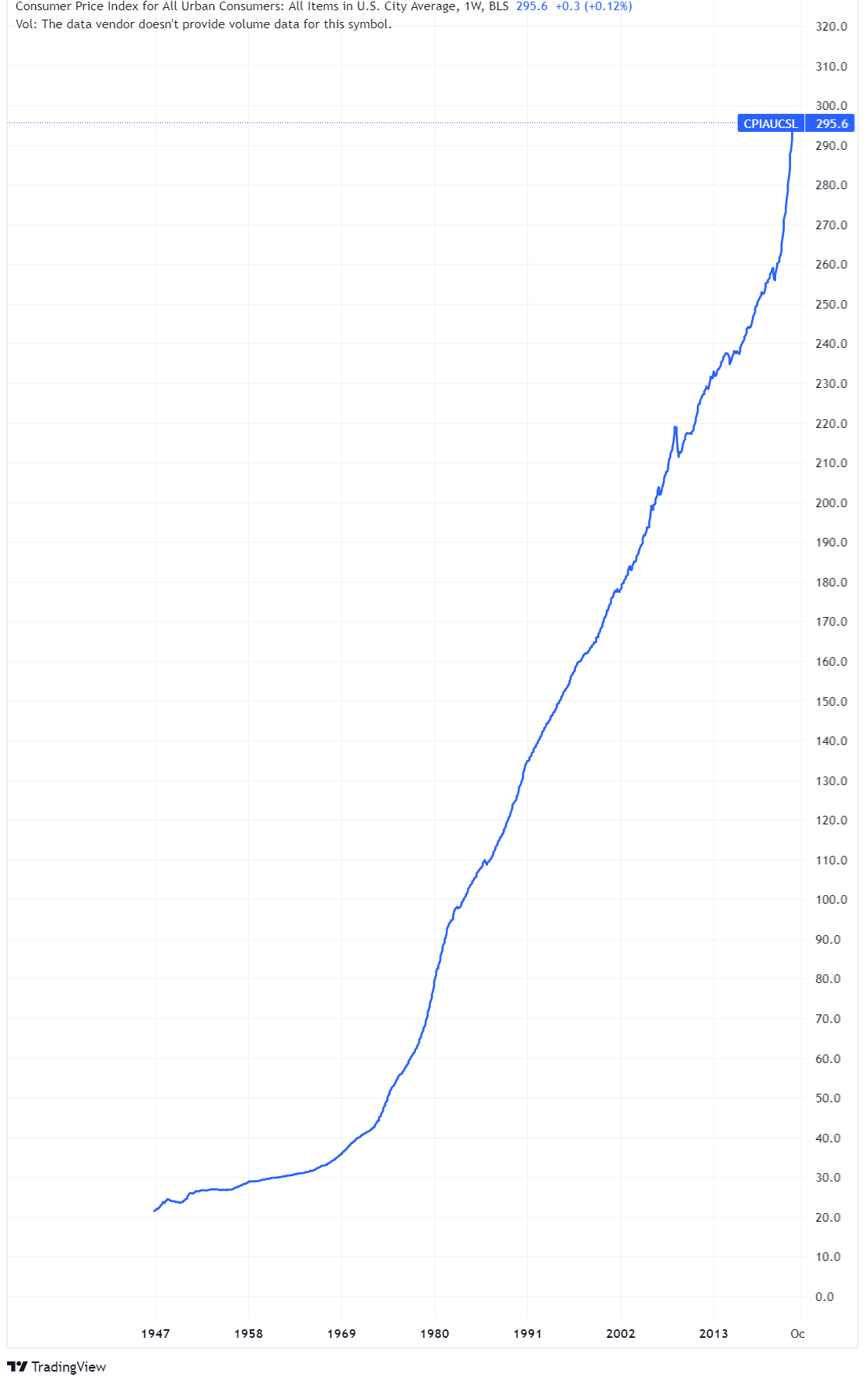

The loss of purchasing power of U.S. citizens can be obtained from the picture below. Keep in mind that the following chart shows erosion of purchasing power in terms of a reserve currency (dollar), which has experienced average inflation of 3.8% over the past 50 years. In contrast many other countries (especially poorer nations and emerging markets) have experienced annual inflation north of 10% (some governments even managed to produce YoY inflation numbers north of 100%).

Secondly, as already mentioned, the artificial increase in the money supply causes a "boom" and "bust" cycle. The initial prosperity comes because inflating money supply typically leads to lower interest rates, which make it cheaper for individuals and businesses to borrow money and can encourage spending and investment, which helps stimulate economic growth and create new jobs. This false sense of prosperity, however, makes it appear as though there is more wealth in the economy than there actually is. This leads individuals and businesses to making investment and spending decisions based on this false sense of prosperity, which leads to a misallocation of resources. For example, businessmen may overestimate demand and order too much inventory or invest in projects that are not profitable because they believe that there is more demand for their products than there actually is. Such behavior leads to overproduction and a surplus of goods, which can eventually lead to a recession. Additionally, since fiat money is not backed by a physical commodity and has no intrinsic value, its value can fluctuate based on a number of factors, including the stability of the issuing government and the overall state of the economy. This lack of inherent value can make it vulnerable to sudden changes in market sentiment, which can lead to financial instability on their own.