Weekly Crypto Recap w/ NewsCrypto

Welcome back, NewsCrypto enthusiasts! It's time for another edition of the NewsCrypto newsletter.

Today we are going to talk about Bitcoin's halving and what are the potential effects it will have on the price of Bitcoin and the crypto market in general as well as technical analysis of Bitcoin to give you an idea of what's to come.

What's on the menu today?

1. Breaking Crypto News

2. Crypto Fear and Greed Index

3. BTC TA Analysis

4. Bitcoin's 2024 Halving

5. Funniest Meme of the Week

News Recap

· Potential $25 billion of inflows after the launch of Hong Kong's spot BTC and ETH ETFs.

· US senators introduced new stablecoin bill - aiming to ban algorithmic ones

· Senate renews spying law with potential focus on crypto sector

· Institutional adoption in blockchain and crypto is at its highest point

· Ethereum ETFs may be coming soon - long-term holders are optimistic

· Runes protocol went live enabling creation of fungible tokens on Bitcoin

Would you like to read more about each piece of News?

Check out the News section on our educational platform here 👇🏼

https://app.newscrypto.io/news

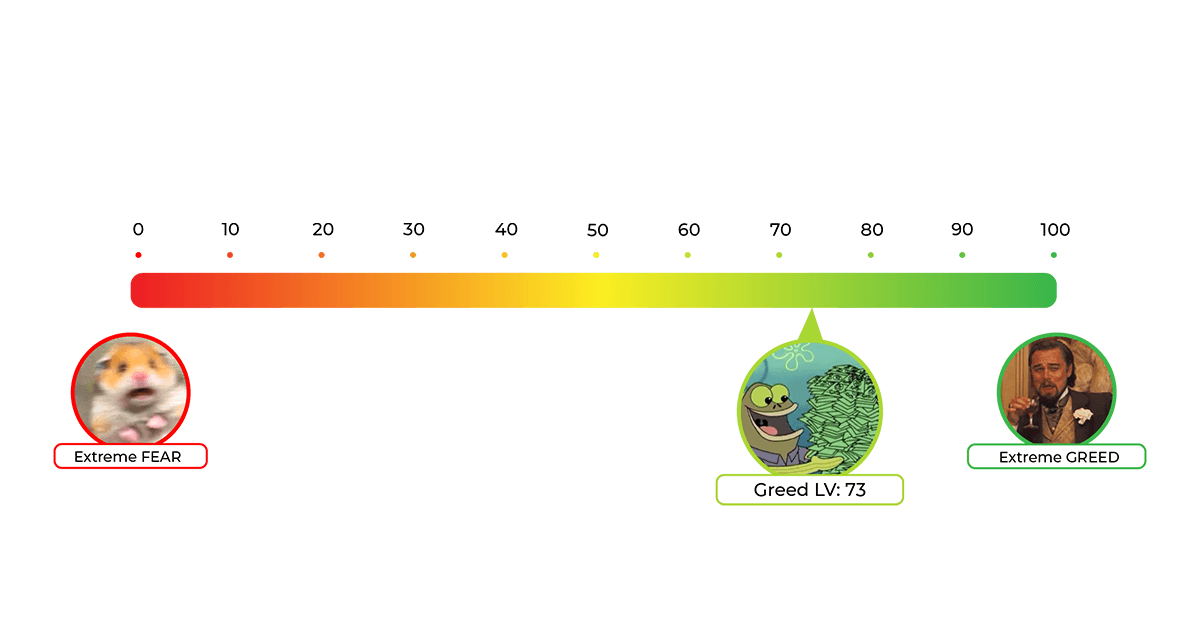

Crypto Fear and Greed Index

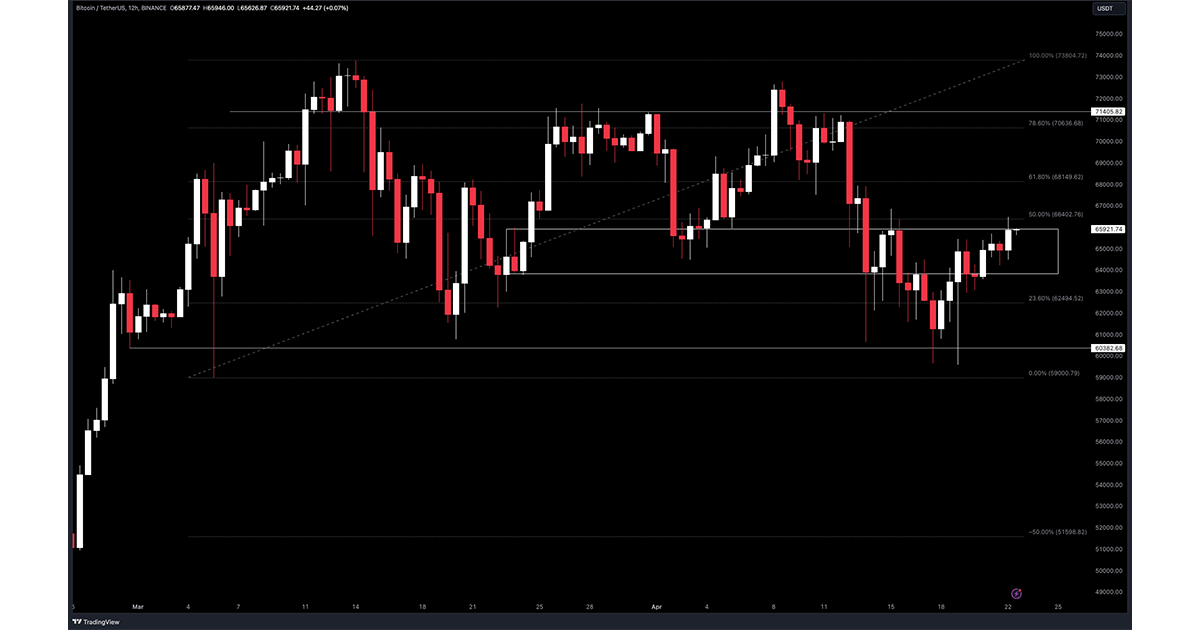

Bitcoin TA Analysis

1. Bitcoin Daily Time Frame

Bitcoin is proving bears wrong! Seems like $60k was an awesome discount to snag before the halving and before the bull run kicks off.

At the time of writing $BTC is trying to push above $66.5k and turn it into support. Once/if this happens it will be a great sign it's ready to push up to $71.5k again. Then turning this strong resistance into support would mean $80k will come soon but be wary that Bitcoin has deviated above $71.5k resistance twice so it may happen again and then continue to range between $60k and $74k.

Bitcoin is in an uptrend - higher highs with higher lows. If you are trying to trade this move look at lower time frames and place SL below the previous low with some room just in case + TP at the top of the range.

Bitcoin's 2024 Halving

The Bitcoin network marked a significant milestone at 8:10 pm ET on Friday in New York, as the much-anticipated 2024 Bitcoin halving event occurred, reducing the mining block reward from 6.25 BTC to 3.125 BTC. This event, which happens approximately every four years, is a mechanism built into Bitcoin's protocol to reduce the rate at which new bitcoins are generated by the network to control inflation.

Historically, halving events have had a profound impact on Bitcoin's price and the broader cryptocurrency market. This year's halving, the fourth of its kind, is particularly notable because never until now has Bitcoin gone past ATH before the halving. Either this will be the bull run of our lifetimes or it will be boring and short; we will see but we think the 1st option is more probable.

Historical Impact and Market Research

In previous halvings, Bitcoin has shown significant price increases. For instance, after the 2012 halving, Bitcoin's price surged nearly 100x from $12 to $1,164 within a year. Similar patterns followed the 2016 and 2020 halvings, with prices peaking at all-time highs long after the rewards were cut. However, this halving was preceded by a new all-time high price of more than $73,500 in March, deviating from past cycles where price peaks occurred post-halving. This has introduced a new layer of uncertainty about future price movements.

At the time of the halving, Bitcoin's price remained relatively stable, trading around $63,783. Analysts speculate that if historical trends continue, the peak of this cycle might occur in early 2025.

Mining Industry Adjustments

The reduction in block rewards means that miners now earn fewer bitcoins for the same amount of computational power. This change is expected to have a significant impact on the profitability of mining operations, particularly affecting those with higher operational costs and weaker balance sheets. In anticipation, many miners have prepared by acquiring more efficient mining equipment, securing cheaper energy sources, or expanding their operations to maintain profitability.

Some well-capitalized miners see this as an opportunity to consolidate the industry, possibly acquiring smaller operations that might struggle to stay profitable under the new rewards regime. This could lead to further centralization of mining power in the hands of a few large players, a development that could have significant implications for the decentralization ethos of Bitcoin.

Looking Forwards

As the Bitcoin community and investors watch closely, the aftermath of the 2024 halving will provide valuable insights into the resilience and maturity of Bitcoin as a digital asset. The reduction in supply rate is a test of Bitcoin's fundamental value proposition as a deflationary asset, which could either lead to increased investor interest or necessitate adjustments in strategy for those involved in its ecosystem.

Funniest Meme of the Week