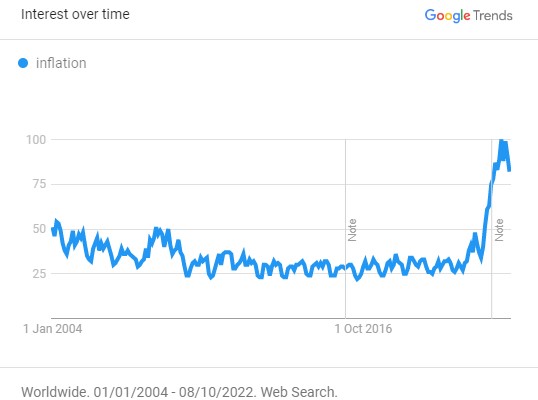

On Thursday we will get Consumer Price Index (CPI) data for September, which is expected to cool off to 8.1% year-over-year. When prices are rising at such a rapid pace, it means people are dealing with an unprecedented increase in the cost of living. No wonder inflation has been one of the hottest topics in the past year, not only in the financial world, but throughout society as a whole. One proof that consumers have been struggling with massive price increases is the simple fact that Google searches of the world ‘inflation’ have more than doubled in the past year and continue to be elevated far above any previous level in the history of the web (you can read more on why this is only becoming more relevant in the past few weeks here).

Photo #1: Google searches of the word ‘inflation’

There are many misconceptions about what started this inflationary fire and one of the goals of this article is to reveal what is the sole source of inflation, clearing up any popular misconceptions that are circulating in mainstream media. Of course, it will also provide an answer to the question in the title: ‘Who are the winners and losers of inflation?’ Although it is difficult to argue someone can actually benefit from rising prices, you’ll find out that someone actually reaps the benefits of inflation. Moreover, people who get adversely affected by rising prices don’t all get hurt to the same degree, as some get harmed to a greater extent than others.

If everything seems a little confusing, don’t worry as we’ll clear up any misunderstanding throughout the article. If you stick around until the end, you will surely gain a thorough understanding of inflation, its causes, as well as consequences that come with it. If you’re ready, let’s dive right into it!

What causes inflation?

If you ask an average mainstream economist what caused the inflation surge, which has been going on for the past year, there is a high chance they’ll attribute it to covid lockdowns and/or the war in Ukraine. Based on their understanding of the situation, each of these events caused supply shortages that have, as the law of supply and demand suggests, put upward pressure on prices. Some may go even further, putting the blame on companies, which apparently got really greedy recently, so they’ve decided to start price gouging their customers.

Not surprisingly, the reality is a bit more complicated. Actually there are countless factors that determine prices of goods at any time, so supply shortages caused by government imposed lockdowns and war raging in Ukraine have probably played their roles in at least a portion of price increases. Similarly numerous other factors were also responsible for contributing their part to the combined price changes of particular goods. What all of the just outlined sources of inflation have in common, is that they shift the blame away from the real source of inflation - the Fed (and other central banks around the globe).

Why the Fed? Because it has a monopoly over emission of ‘freshly printed’ dollar bills. There are countless examples in history books, which show that inflating money supply (issuance of new dollar bills, which don’t have any backing) causes subsequent price increases, yet politicians (which bankers at the Fed are, despite pretending they act independently) choose to ignore it. Interestingly this was thoroughly understood not too long ago. For example if you open a 1960s dictionary of economics and look up a definition of the word inflation, you’ll find out that a little over 60 years ago economists defined inflation as ‘expansion of money supply, which causes advances in price levels’. This definition points fingers not only to the cause, but also to the effect of the policy.

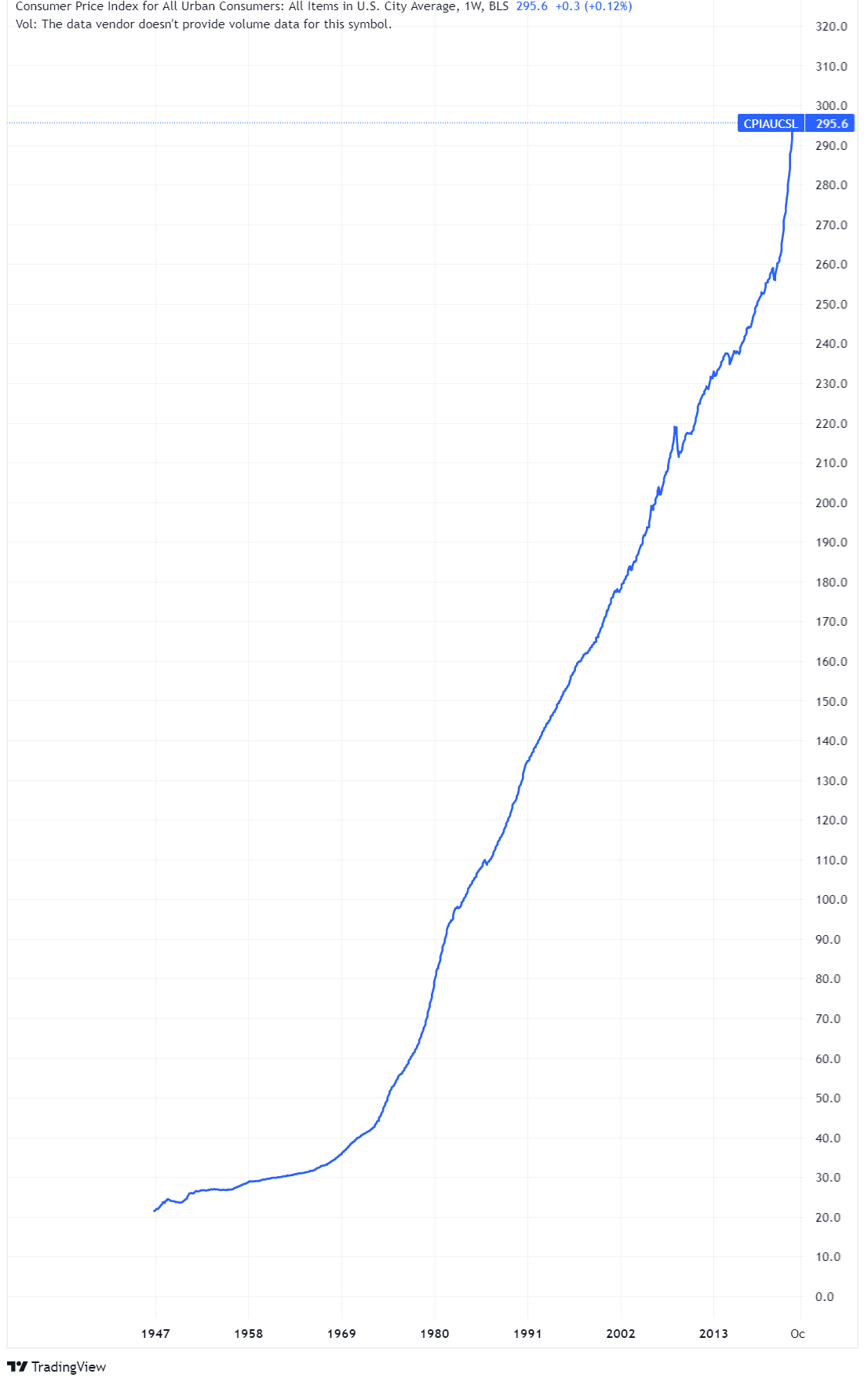

While the Fed has been robbing US consumers of their purchasing power ever since its inception in 1913 (take a look at the picture below, which shows growth in the price of the CPI basket throughout years), it has gotten even worse since the president Richard Nixon closed the gold window in 1971. But what has forced prices to increase almost vertically after 2020? As already mentioned, government induced lockdowns have already reduced the supply of goods on their own. Now, how did the Fed react? They’ve flooded the economy with freshly printed dollars (around 40% of dollars in circulation now, have been injected as a response to the Covid crisis).

Photo #2: Consumer Price Index through years

Photo #2: Consumer Price Index through years

Consequently people that didn’t contribute their share to the ‘pool of goods and services’, went on a shopping spree, bidding up their prices in the process. The Fed has basically helped increase demand in the face of lowered supply. Of course prices had no way to go, but up. While it would have been obvious to economists 60 years ago that such a response is a recipe for disaster, the Fed continued to assure everybody that consequent price increases were transitory. Somehow these central planners always think they’re so competent they’ll end up with a beneficial outcome, despite following a play-book for disaster.

Who benefits from inflation? Whom does inflation hurt?

The freshly printed money only benefits the first recipients of it, which is the government. That is why inflation (the expansion of the money supply, as well as the consequent price increases) is often regarded as tax. We can’t sum it up better than the famous economist Thomas Sowell: “Inflation is in effect a hidden tax. The money that people have saved is robbed of part of its purchasing power, which is quietly transferred to the government that issues new money.”

When the government wants to spend more, they need to get money first. They can either get it by raising taxes and henceforth collecting additional revenue, or going into debt. Now keep in mind that government borrowing isn’t necessarily inflationary. If debt securities are all bought by investors and financial institutions, no new money gets created. Unfortunately these ‘private buyers’ have neither enough savings nor demand for government bonds to absorb all of the supply, so the central bank has to step in to buy them with newly created money.

Note how the government increased their spending without raising taxes. The adage ‘there is no such thing as a free lunch’ still holds true, so people pay for it through loss of their purchasing power and depletion of their savings pool in real terms (because of the rising prices that occur as a result). These price increases harm everyone, especially the poor and the lower middle class, who have lower income and may have to directly cut their consumption. Contrarily rich people don’t have to buy less (as they can afford higher prices), but rather only save and/or invest less as a consequence. Additionally, wealthy people usually own assets that tend to go up with inflation, which helps offset negative consequences that come as a result of expansion of the money supply.

Conclusion

Let’s sum it all up with a quote by famous Nobel Prize winning economist Friedrich Hayek: “Practically all governments of history have used their exclusive power to issue money to defraud and plunder the people.” Don’t get fooled by the Fed who is trying to present itself as an ‘inflation fighter’, rather than the ‘inflation creator’ it really is. The Federal reserve and the government have been engaging in a symbiotic relationship, which benefits politicians and elites, at the expense of you. If you want to mitigate the damage, you will have to act. We recommend you to do what the rich people are doing and hedge against inflation by buying assets that will increase in value along with inflation. Even though the times we’re living in may be extremely turbulent, keeping your cool and acting rationally is the best way to get ahead.