Last week we saw Federal Reserve Chairman Jerome Powell challenge if there would even be a need for cryptocurrency in the near future.

As comical as that may sound for those of us that understand cryptocurrency and also understand how the current monetary policies in the USA have impacted its citizens and businesses, I also felt the need to revisit and update this How To Crypto blog from last year since so many people have reached out to me asking for my opinion on his statements. His exact statement was “You wouldn’t need stablecoins, you wouldn’t need cryptocurrencies, if you had a digital US currency. I think that’s one of the stronger arguments in its favor.”

This was in a meeting that was discussing the US exploring the option of a digital dollar, the US’s form of a Central Bank Digital Currency or CBDC. This comes days after the Fed for the first time has warned about cryptocurrency volatility in its Monetary Policy Report. Let’s also point out that in the same week, Treasury secretary Janet Yellen said she sees several more months of rapid inflation before easing. The reason to add this statement to the mix is the glaring fact many do not realize.

Sure, a digital dollar from a payment standpoint could function better than current systems. But that fails to look at the underlying broken foundation that is causing rapid inflation and the ever-widening wealth gap not just in the USA, but globally. That broken foundation is the current monetary policy, which includes over-printing of dollars, especially over the last 18 months. The Fed has lost control over inflation and we are just starting to see the ramifications of it. So a digital dollar would, in essence, be better tech on the same broken system. Now let’s dive deeper in this How To Crypto Report.

We have seen many wars over the years of history and it appears there may be another one brewing. Although this one may play out without one battle or gun even being fired. I am talking about the currency war; this is not centralized versus decentralized.

It is each country racing to be the leader in developing a Central Bank Digital Currency, also known as CBDC. While many governments around the globe initially dismissed cryptocurrency with the rise in popularity of Bitcoin and many altcoins, now they are paying attention as they see the world’s appetite for change. Top that off with the fact we live in a digital world now where many transactions happen without the need for a physical currency and the recipe is brewing for a rise of Central Bank Digital Currencies.

Source: ledgerinsights.com

Though many major countries have been spending resources to research the feasibility of CBDC’s, the Bahamas launched the first CBDC, the Sand Dollar, on October 20, 2020. Several other countries, including China, have test or pilot programs in the works, but the Bahamas was the first to make it available nationwide there. Transfers of the Sand Dollar are made from users' mobile phones as 90+% of the Bahamian population use mobile phones. The currency can be used at any merchant with a “Central Bank” approved e-wallet. Chaozhen Chen, the assistant manager of eSolutions at the Central Bank of The Bahamas, was quoted in a recent Cointelegraph interview as saying the CBDC would help provide “access to digital payment infrastructure or banking infrastructure” for underbanked and unbanked residents. China is not far behind with development of the digital Yuan. Last year, China did a $1.5 million(10 million Yuan) giveaway test of their digital Yuan in the city of Shenzhen as part of their pilot program.

It was distributed to 50,000 residents in a lottery style giveaway, and can be spent at any of the over 3300 merchants in Shenzhen’s Luohu District. Any unused money not spent by deadline would be taken back. Since then, China has continued to push out tests of their digital Yuan and even making it available to all of those participating in the Olympics in Japan. The UK and Canada have made it no secret they are exploring the possibilities of a CBDC as committees and resources have been thrown at researching this. The USA has teetered back and forth on their stance on the creation and implementation of a CBDC US Dollar.

One school of thought, similar to arms and past industrial races, the USA needs to take the lead and be one of the first to develop and innovate. The other school of thought is that the USA wants to see other countries roll CBDC’s out and learn from those countries' mistakes before fully embracing the US Dollar. This is important for the entire world as we could see the dominance of the US dollar fall if they fail to adopt and innovate in this space.

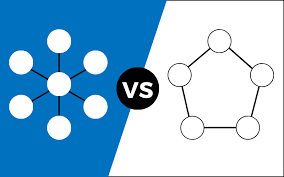

Before we dive deeper into CBDC’s impact on cryptocurrency, we need to understand some of the principles of true cryptocurrency. Sure, any entity, including governments can create a digital currency, but will it meet the litmus test of true cryptocurrency, or will it be a Frankenstein-ish type creation that resembles cryptocurrency but is in no way the same. As defined by Andreas Antonopolous, a very well known proponent of Bitcoin and cryptocurrency, there are 5 pillars to open blockchains which in turn is why I use the term “true cryptocurrency.”

Even if there is a distributed ledger CBDC’s run on, if it doesn’t meet the 5 pillars then it will not be a true cryptocurrency and not our best option to transact.

The 5 pillars of open blockchains are Open, Borderless, Neutral, Censorship Resistant, and Public. These systems that meet these five pillars thrive off of decentralization, immutability, and transparency. Many governments throughout history have fought to have a system of checks and balances which eventually becomes corrupt due to the lack of decentralization and transparency. True cryptocurrencies will operate on decentralized systems and the transparency and trust comes in the form of the code, putting trust in absolutes like math and code, rather than in people.

Source: Parkmycloud.com

Open means anyone can use or open to all. With many regulations, we constantly see systems that exclude many people from participating so we will probably see most CBDC’s will not be open. Borderless is easy to determine as each will want to use their own as they develop. I doubt after seeing how history was written since the US Dollar was pegged as the world’s reserve currency, most countries will want to opt for more power from their own CBDC rather than another country’s CBDC. So most CBDC’s will not be borderless; they will be restricted.

Neutral is also something they will not be. The CBDC itself may be neutral in theory only, but you can bet the system that it runs on will not be neutral. It will be designed as a system of surveillance and control that will be packaged as a way to protect the people. Don’t be fooled. This will be so those who are greedy and power hungry can remain in power and control with the new systems. CBDC also will have no essence of censorship resistance for the same reasons we just mentioned. It will be a heavily censored system that will be able to monitor and dictate when and how you can spend your money.

Public in terms of the network will also not be the case. It will be a private and closed network, but not private in the way it benefits the citizens that use it. It will be closed and private to those in power where greed and corruption has existed for years and will continue to try to maintain its grip on society. Cryptocurrency has the benefit of peer to peer transacting without the need for a middleman. You can bet that with CBDC’s there will be many vampire companies pop up or pivot to service this platform, just as Visa, Mastercard, and many banks latch on to these systems to generate revenue by charging fees.

Now that we’ve looked at what CBDC’s are and how they differ from cryptocurrency, we need to get to the meat of the discussion that most people are asking: how will CBDC’s impact the cryptocurrency markets and adoption? Will a certain CBDC be a Bitcoin killer or make 99% of cryptocurrencies worthless?

Absolutely not. The following view is only my opinion based on my own understanding and research. I challenge you to evaluate my opinion, but then do your own research to come up with your own conclusion.

Only time will tell in this, but here is what I think will happen. There may be some fear and uncertainty in the cryptocurrency market as countries start to roll out their CBDC’s. It may cause some initial volatility as people who don’t truly understand all the true benefits and freedoms allowed with what I call true cryptocurrencies. Most people don’t question systems as long as they are “working,” but we have all seen countries where those abuses of power have brought that country’s financial systems to halt.

This has happened in places like Venezuela, Zimbabwe, Argentina, Cyprus, and Turkey to name a few. However, after the initial fear and uncertainty for cryptocurrency investors, CBDC adoption should be a good thing for the overall adoption of true and decentralized cryptocurrencies like Bitcoin and others. As more people who were skeptical of digital items having value start to realize how much better these digital systems can work, they will also realize that there are better options and better technologies than CBDC’s. Governments have never been one to lead technology and innovation, but instead, they usually lag. Therefore, by the time CBDC’s go mainstream, the technology with cryptocurrency and decentralized finance will be way more advanced and user friendly than the CBDC’s.

Not only from a consumer adoption, but as businesses acclimate to accepting digital currencies, they may also be more open to accepting either all cryptocurrencies or at least the main decentralized ones. The majority of the population is resistant to change until their hand is forced or they can see the benefits outweighs the discomfort of learning. If there is any interoperability between the payment systems of CBDC’s and cryptocurrencies, we could see adoption speed up even more.

Another factor to consider is what we touched on in an earlier paragraph. If there is a heated currency war between countries launching CBDC’s, we could see extreme volatility in the values of each CBDC among each other as exchange traded pairs. This could lead to rapid inflation sped up on top of inflation rates from reckless printing and monetary policies executed before the emergence of CBDC’s. This would cause a further decoupling of the cryptocurrency market from traditional markets as savers and investors look for a “safe haven” to store and/or protect their wealth. People would flock to cryptocurrency like never before if that were to happen.

In conclusion, there is so much speculation on what could happen with the emergence of CBDC’s. It is inevitable that those in power will want to remain in power. Governments are also all dealing with failing monetary policies in relation to the mass printing and inflation from that printing of their fiat currency. Cryptocurrency will continue to develop and evolve as the masses get tired of the abuse of power by governments and banks. People will continue to move towards currencies that benefit the people and protect their freedoms and basic human rights. Only true cryptocurrencies can give you that, not CBDC’s.

Content written by Blockchain Wayne and NewsCrypto Team