Crypto Chronicle w/ NewsCrypto

Welcome back NewsCrypto readers!

In today's edition of Crypto Chronicles we are going to discuss the effect of Hong Kong's approved spot BTC and ETH ETFs and if now is the prime time to load up on Bitcoin and altcoins.

Before we dive in, Biden proposed a 25% tax on UNrealized gains for high-net-worth individuals.👇

Here's what we got on the menu today:

1. Hong Kong's ETF Inflows Will Dwarf US's

2. Time to Buy Bitcoin & Altcoins?

3. Funny Meme

Will Hong Kong's ETF Inflows Dwarf US's?

Hong Kong is positioning to become a central hub for cryptocurrency investments with its recent regulatory green light for spot Bitcoin and Ethereum ETFs. This move by the Hong Kong Securities and Futures Commission (SFC) is not just a local milestone but has global implications.

Details of the Approval

The approval involves prominent firms such as China Asset Management, Harvest Global Investments, and Bosera International, who are set to launch both BTC and ETH funds. This comes on the heels of the SFC's unofficial nod earlier this month, indicating a strong institutional backing for these digital asset ventures.

Market Impact and Predictions

Hong Kong's ETFs are not expected to draw as massive inflows as their U.S. counterparts initially but this is a significant step considering the US hasn't approved ETH ETFs just yet. This showcases robust confidence in the region's growing crypto market and hints at a larger trend of increasing crypto adoption in traditional finance sectors.

Looking Forward

The launch of these ETFs could catalyze other countries in Asia to adopt similar financial products, enhancing the global cryptocurrency market structure and investor access. This strategic step not only strengthens Hong Kong's position as a financial leader but also signals a larger shift towards embracing digital asset classes in mainstream portfolios.

Time To Buy Bitcoin & Altcoins?

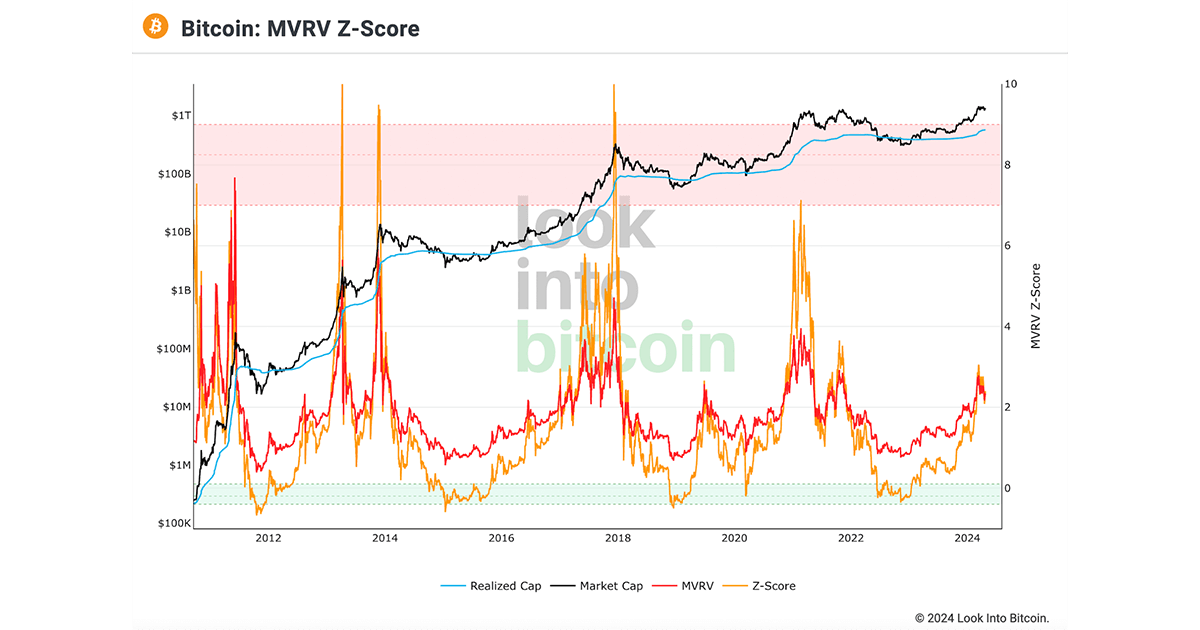

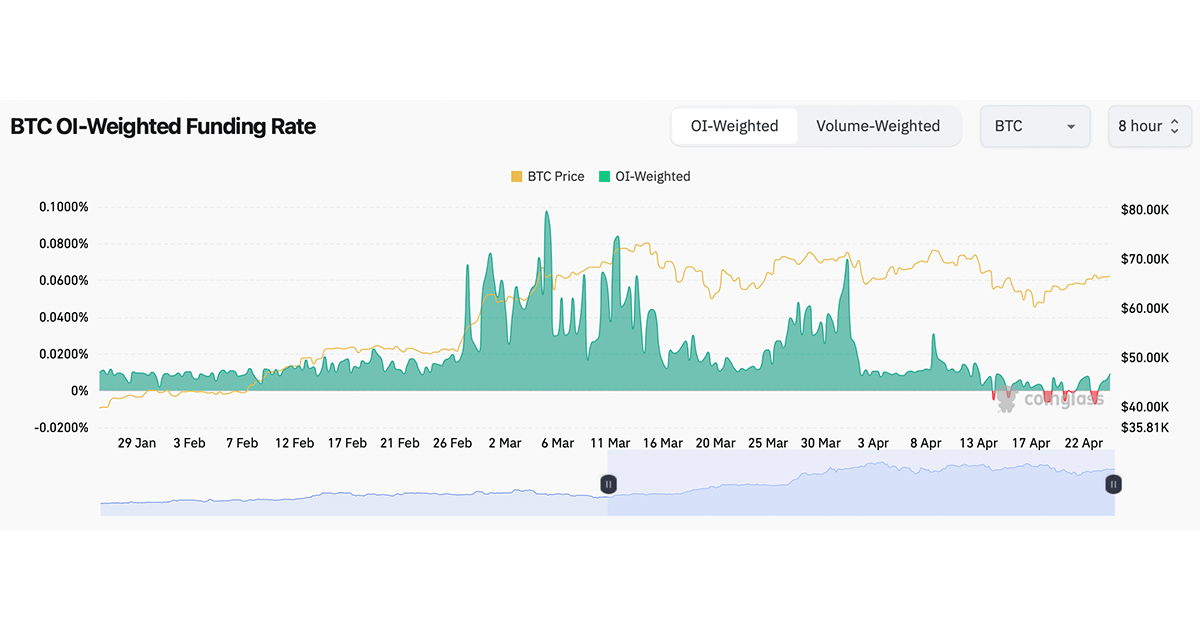

Two key on-chain metrics, the Market Value to Realized Value (MVRV) and the Open Interest (OI) weighted funding rate, are currently suggesting that Bitcoin might be entering a prime buying phase. This analysis provides crypto traders and investors with critical insights into when might be an advantageous time to enter the market.

Exploring the Metrics

· MVRV Ratio: This metric indicates whether Bitcoin is undervalued or overvalued compared to its fair price. A lower MVRV ratio suggests that Bitcoin is undervalued, and the current MVRV score of 2.32, which is down 6.45% since April, points to potentially favorable buying conditions.

· OI Weighted Funding Rate: This reflects the cost of holding Bitcoin futures and has recently shown a decrease. A lower funding rate generally indicates less cost to hold positions and could signal a good entry point for traders looking to buy.

Market Reaction and Analyst Insights

Recent shifts in these metrics have stirred discussions among market analysts, with some pointing out the healthiness of this reset as an indicator of a stable yet growing interest in Bitcoin. The lower funding rates and the decreasing MVRV score align to suggest that now might be a strategic buying opportunity for long-term gains.

Conclusion

These on-chain metrics are invaluable tools for understanding market dynamics and making informed investment decisions. While they suggest a favorable moment for purchasing Bitcoin, you should conduct your own research and consider the broader market conditions before committing to any trades.

Funny Meme

Disclaimer: This newsletter provides educational content only and is not financial advice. It does not offer investment recommendations or encourage buying or selling assets. Please exercise caution and conduct your own research before making any financial decisions.