As a trader or investor, many new people struggle with where to enter and exit their market positions. They turn to charts to try to map out their plan of attack.

Many times, I see people add way too many indicators to a chart without understanding how each one truly operates. On the other side of the coin, many do not slow down to simply understand how the candlesticks themselves can tell a story of what that particular cryptocurrency may do next.

All of trading is basically a game of chance, and utilizing a particular set of indicators can help you with your risk management. No matter the indicators you set your sights on, learning and understanding the basics of candlesticks on the charts should be a vital part to your trading strategy. As a new trader or investor, you may have looked at the flow of green and red candles and made a decision based on what your intuition was telling you depending on the color mix of candles you see in front of you, but that may only work once or twice if you are lucky. Even a broken clock is right twice a day.

To ensure a good long term trading strategy, take the time to learn how to read and use candlestick charts, as it can be a powerful tool in your trading tool belt. As I’ve mentioned in past How To Crypto blogs about trading, there is no one-size-fits-all trading indicator or indicators, but learning to use a mix of chart tools and indicators can help you make better decisions about when to enter and exit a trade, but also when it might be best to avoid a trade.

Let’s start by explaining what a candlestick chart is. Most charting tools have 2 options, candlesticks or line graphs. I would recommend everyone switch to candlestick charts if you have not already. Candlesticks allow you to see a story unfold in each candlestick printed on a chart. Each candlestick individually tells you a story about what happened within the timeframe selected, and together collectively, candlesticks can tell you a story about what is happening in the momentum of the market, including how the candlesticks react to support and resistance levels.

Candlesticks allow traders to see market trends as they develop on the chart. Simply put, green candlesticks represent rising market prices and red candlesticks represent market prices dropping. Each chart allows you to select a timeframe, which means the timeframe you select is represented by one candlestick. You can select timeframes as such as 1 minute, 1 hour, 4 hour, daily, weekly or many other choices in between. For example, if your chart is set to 1 day, each candlestick represents 1 day. So looking at a chart and focusing on say 14 candlesticks will show you a trend over 2 weeks. Candlesticks can help you gauge how probable or improbable an expected move in the market is.

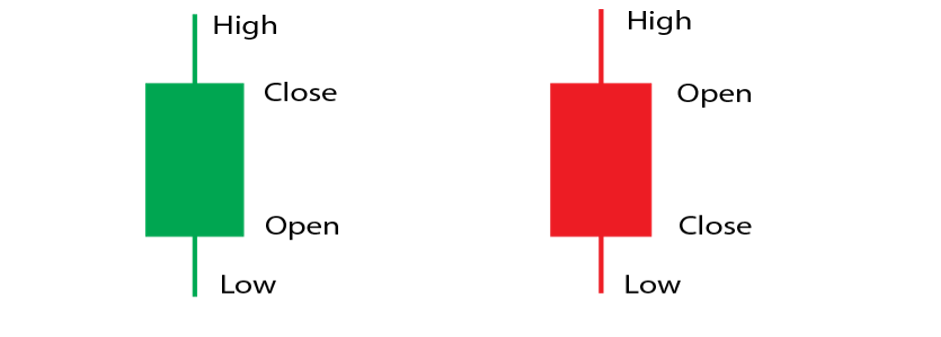

Each candlestick has 4 main parts: open, close, high, low. The Open is the beginning trading price at the open of the time period. The close is the ending trading price at the close of that time period. The High is the highest trading price during that time period. The Low is the lowest trading price during that time period. As you can see from the example below each candle shows what many call a wick or a shadow, which is the thin line extending from the body. If a candlestick has no wick on the bottom, then that means if it is green, then the open and the low are the exact same, and if it is red, the close and the low are the same.

If there is no wick on the top of a candlestick, if it is green, then the high and the closing price are the same, and if red, the open and the high are the same. The relationship between each of these 4 values will determine exactly how each candle will look. The distance between open and close is referred to as the body, and the distance between the high and the low is known as the range. Each candlestick shows you the price battle between buyers and sellers.

Candlestick charts are easy to read and show more details than a line graph. The longer the body is, the more volatile and prominent the buying and selling are. The shorter the candlestick usually indicates less price movement, which could indicate indecision or consolidation.

A longer green candlesticks can show that the bulls controlled that time period, and the longer red candlesticks can indicate the seller dominated that trading time period. A longer wick on the bottom usually is an indication that buyers took control of the time period after a brief period of sellers controlling. A longer wick on the top usually is an indication that sellers took control after a short period of buyers controlling.

Below are some common candlestick patterns that you will see on charts and see and hear people refer to these. This is not an all inclusive list, just some examples of some common patterns. There are many guides and books on candlesticks, many hundreds of pages long, but this is just to get you aware of the correlation in the candlesticks shapes and patterns and how they can impact market movements. Trends with multiple candlesticks can correlate with either the rise of a price or fall of a price, or confirm either a continuation of a pattern or reversal of a pattern.

At a glance, you can see either the widening or tightening of a pattern. Also, say you see a consistent string of long wicks on the bottom of candle bodies, that is an indication that there is a good bit of pressure and momentum trying to move the price up, which could lead to a breakout to the upside. The same can be said for a pattern of multiple long wicks on the top of candle bodies as that is an indication of a lot of sell pressure and could result in a drop in price.

Understanding candlesticks and using them to trade can be an important tool in your toolbelt. The great thing about charts is you can go back in history and identify some of the candlestick trends and patterns we discussed and see how the market reacted to those.

Also, make sure you have an account on the Newscrypto platform as you can learn more in the education section, and also learn by evaluating technical analysis that other members share. The more you learn about different trading strategies, the better you can become at being a profitable trader. You will never be right 100% of the time, but knowledge, skill, and proper risk management can make a world of difference in your trading success.

Content written by Blockchain Wayne and NewsCrypto team