(3 min read)

DeFi promises to make money and payments globally accessible to everyone.

Currently, there are around 1.8 billion unbanked people lacking financial service on this planet!

The Decentralized Finance (DeFi) movement opens alternative to every financial service you use today, either be savings, loans, trading, insurance, and more — accessible to anyone in the world with a smartphone and internet connection.

After reading this blog post, you will be armed with essential De-Fi knowledge, what the advantages and perks are, and how to do your research. We will cover details in the following blog posts.

DeFi solutions are now possible on smart contract blockchains, like Ethereum. “Smart contracts” are programs running on the blockchain that can execute automatically when certain conditions are met.

These smart contracts enable developers to build far more sophisticated functionality than simply sending and receiving cryptocurrency. These programs are what we now call decentralized apps or dApps. You can think of a dApp as an app that is built on decentralized technology, rather than being built and controlled by a single, centralized entity or company.

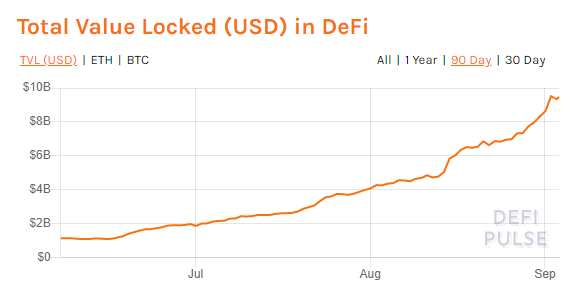

Last year’s growth in the decentralized finance (DeFi) space awoke us from our cold, crypto winter slumber––reigniting interest in the potential of financial decentralization. The total locked amount in DeFi markets is currently surpassing 9 billion $, and the largest share of those funds belong to lending dApps and platforms.

These projects supply users with the ability to lend out cryptocurrency and earn a passive income through interest charged. You’re also able to borrow if you provide collateral via cryptocurrency or Stable Coins.

Not only do these DeFi platforms encourage traders to hold their assets, but it also gives skeptics a more available and lower risk entry into the hype. The future looks bright for DeFi, but we’ve still got a long way to go. The DeFi community needs now more than ever a way to include a more ubiquitous and diverse audience.

The bottom line, De-Fi is unlocking a suite of new and exciting passive income opportunities – earning money with little to no effort at all.

However, everything comes with a risk. Thorough research is needed before investing or locking your funds anywhere. The question is, how and where to DYOR?

When researching the project or any kind of service, be sure to check: website, product, whitepaper, type scam right next to their name in Google (it’s highly likely someone exposed them in the past if they got scammed), try to evaluate projects real and active community, seek information on Twitter, Reddit, and Bitcointalk forum, look at audit reports, etc.

Borrowing and Lending

Decentralized finance allows users to automatically take a loan or borrow funds. In DeFi case, a borrower does not need to find a lender, the smart contract does it and calculates interest rates algorithmically based on supply and demand. DeFi allows borrowers to stake their digital assets as collateral, which are locked within a smart contract until the loan is repaid.

These are the essential everyone in the crypto world should know about DeFi.

Let's dive in details next time, till then, happy trading!