Blockchain analytics firm Chainalysis has released its Global Cryptocurrency Adoption Index for 2022. For the third consecutive year, they ranked all countries by grassroots cryptocurrency adoption, using its unique ranking formula. Instead of simply looking at cryptocurrency volume, the researchers try to evaluate where the most people are putting the biggest share of their money into cryptocurrencies. They do so by dividing the index as a whole into five sub-indexes, allowing for a weighted calculation based on the percentage of income spent to acquire cryptocurrencies.

The methodology makes sure a country with the highest volume accumulated won’t rank as the highest, if the volume isn’t highest in proportion to its population’s overall income. Similarly, even if a country has lots of volume on centralised exchanges and on DeFi protocols, its score might be low in case they rarely participate in the peer-to-peer transfer of value (one of the indexes is based on P2P exchange trade volume).

This way the Adoption index tries to paint a broader picture of crypto adoption. Rather than taking into account solely the country's use of bitcoin and cryptocurrencies as a store of value, also factoring in its use as a medium of exchange.

Source: blog.chainalysis.com

Source: blog.chainalysis.comThe research comes up with quite a few interesting discoveries, which will be discussed in the remainder of the blog. Make sure you stick until the end, so you don’t miss out on anything!

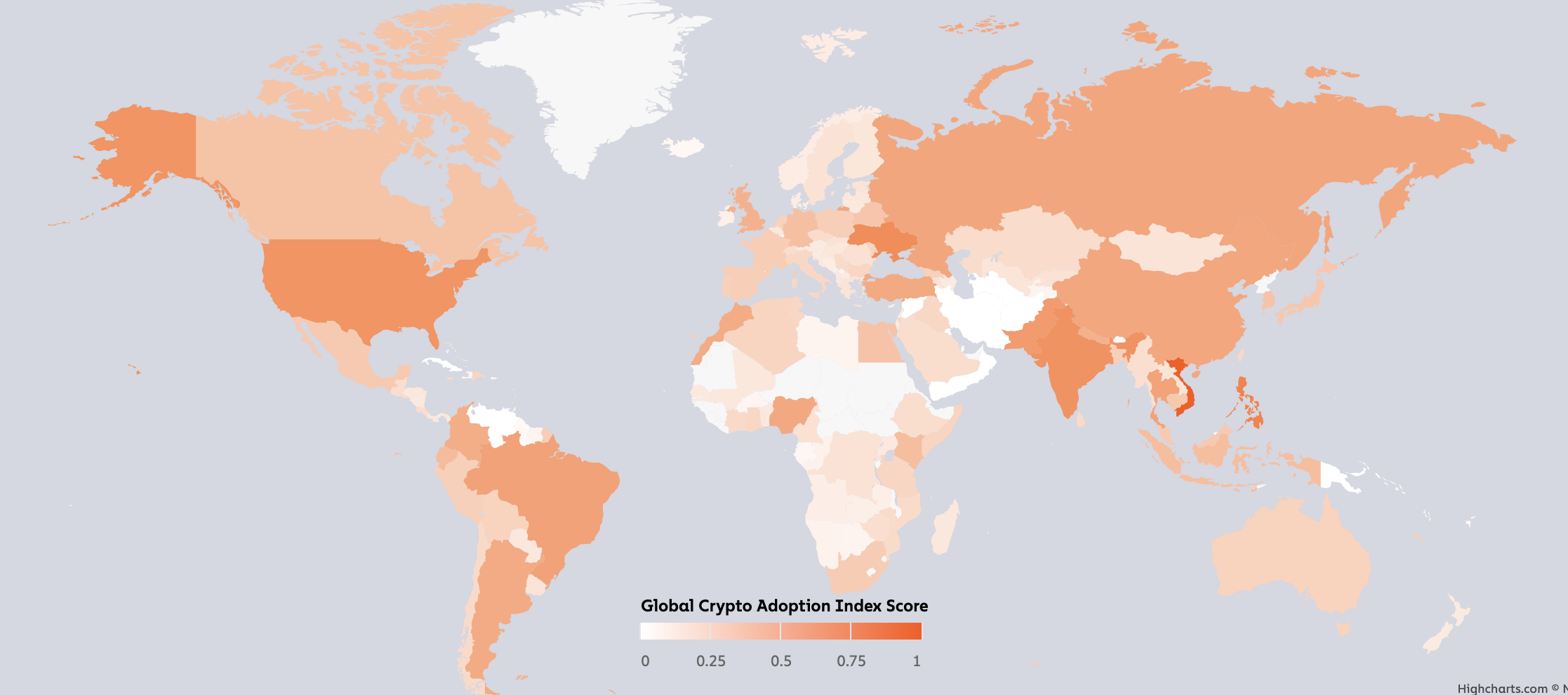

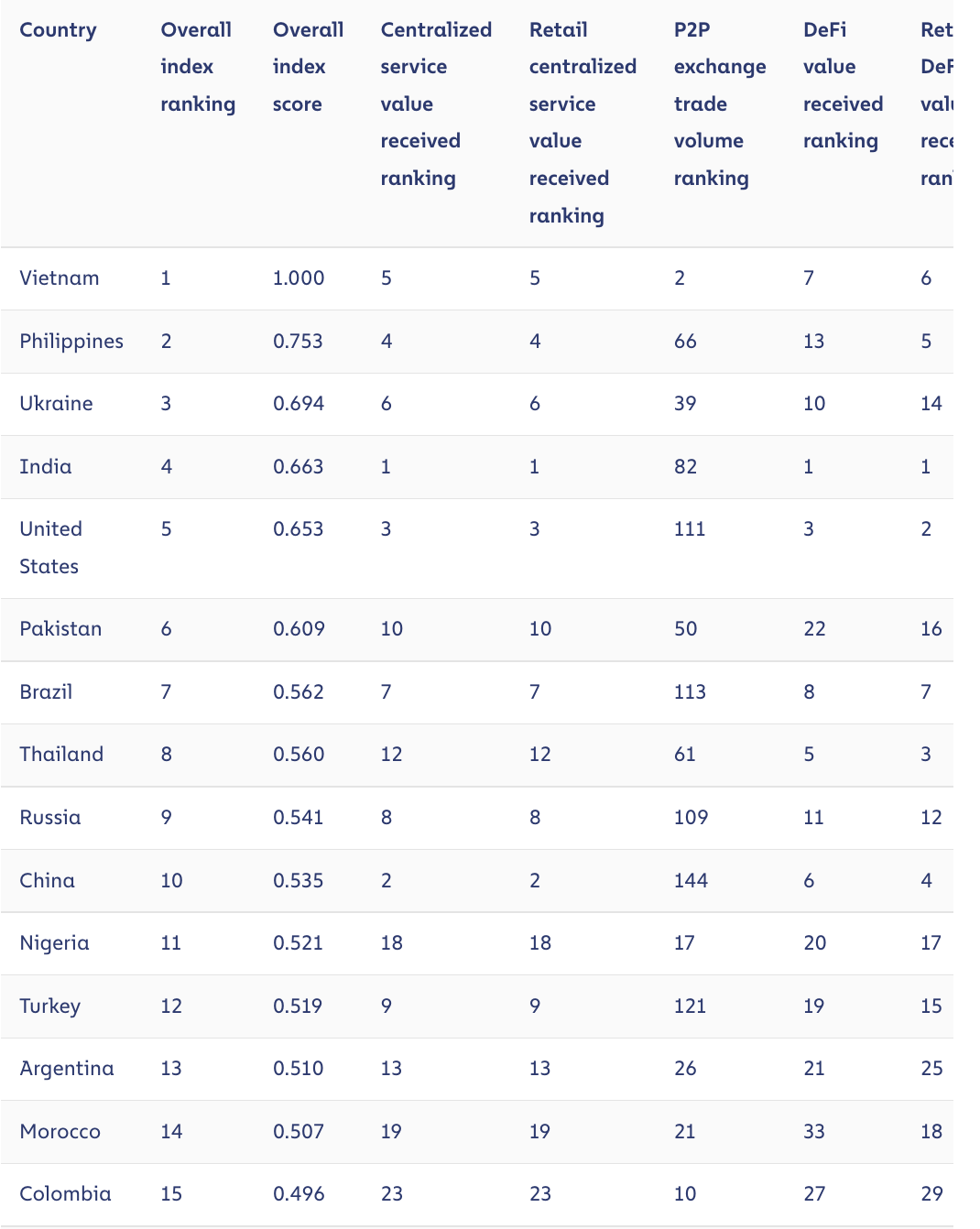

The picture below shows that Vietnam continues to lead the world in crypto adoption (it was already in first place in 2021). Adjusted for purchasing power and population, Vietnam ranks high among all sub-indexes, which seems to be the exception rather than the rule. The Southeast Asian country has been very fond of crypto for quite some time now. According to the poll conducted in 2020, 21% of Vietnamese reported using or owning cryptocurrency, second only to Nigeria at 32%. Apparently, move-to-earn (M2E) and play-to-earn (P2E) models (which we covered in some of our FA reports) are a big thing among Vietnamese people, especially younger generations. On top of the tens of thousands of daily users these apps have, coming from Vietnam, many developers behind M2E and P2E also derive from Vietnam.

Meanwhile, the USA has risen to fifth place, as it was previously ranked eighth in 2021. It ranks in the top three of each sub-index, with the exception of P2P transactions volume (adjusted for purchasing power of course), where it ranks 111th. India sits at the fourth place, but leads the world in centralised purchases.

Not surprisingly, emerging markets continue dominating the Adoption index. Why? A rising use case for crypto in emerging markets is actual payments and value transfers through blockchain technology. This way cryptocurrencies provide people living in unstable economic conditions with unique, tangible benefit. This is the reason almost all of the top 15 countries are actually emerging economies. With the exception of the USA, all countries fall in this category.

Interestingly, China is back among the top 10 countries in Bitcoin and cryptocurrency usage, despite the Chinese government’s ban on all cryptocurrency trading from a year ago(up from 13th place in the last year).

Looking at the chart below we can see that adoption has been growing constantly, accelerated rapidly into the first half of 2021 hand in hand with the biggest crypto bull market ever, declined after a crypto crash and then rose again together with the crypto market. Now that we have been in a crypto bear market for the whole of 2022, adoption has fallen accordingly. This leads us to the key observation of the research.

Source: blog.chainalysis.com

Source: blog.chainalysis.comEven though crypto market and crypto adoption move in tandem, as adoption rises during the bull market and declines during the bear market, these bear markets don’t wipe out bull market adoption. While the overall adoption slows in a bear market, it remains elevated above pre-bull market levels - and that’s one key reason why it’s important to keep building and learning.

The data suggests that many users who enter the crypto space during bull markets, when prices are on the rise, actually stick around even through bear markets, when prices decline. Because of these long-term hodlers, crypto has been extraordinarily resilient. Even during troublesome times the ecosystem has been able to consistently grow, thanks to continually rising blockchain technology usage. Researchers believe that this is a sign of two things. Firstly, crypto participants believing the crypto market is poised to bounce, and secondly people deriving value from the underlying technology. They believe this indicates ‘healthy fundamentals’ and seem optimistic about the future that lies ahead.