Crypto instantly lost upward momentum at the beginning of last week when the Binance and FTX drama, or rather CZ and SBF drama, shifted into higher gear. It caused the Bitcoin to fall from above $21,000 to below the $16,000 level in a time span of only a few days. We’ve already covered what has been happening in the markets last week in our previous blog. Instead of focusing on the past, this time we’ll focus on what could happen in the aftermath of the FTX crisis.

Can this crisis result in cascading effects in Crypto? Can it also spill into other financial markets? How much lower can Bitcoin and other cryptocurrencies fall? If such questions spark your interest, you definitely have to continue reading this blog until the end, as we’ll unpack all of it. Let’s dive right into it!

What does one of the most prominent figures in crypto think?

The founder of Binance and one of the most influential people in crypto, Changpeng Zhao (CZ), compared the current crisis in the crypto markets with the financial crisis of 2008. He believes that recent events could bring about a cascading effect in the crypto industry. He pointed out that entities that were very close to the FTX ecosystem, are most likely to be negatively affected.

Source: CNBC

Source: CNBC

Mike McGlone, senior commodity strategist at Bloomberg went even further, arguing that difficulties in crypto could spread into the stock market. By stating that ‘Bitcoin has been one of the leading indicators on the way up, and it’s a leading indicator on the way down. And it’s just broken down, so expect most dominoes to fall,’ he pointed out that the stock market often moves in the same direction as Bitcoin with a little lag, suggesting further meltdown in crypto could send stocks into turmoil as well.

What is the institutional take on the matter?

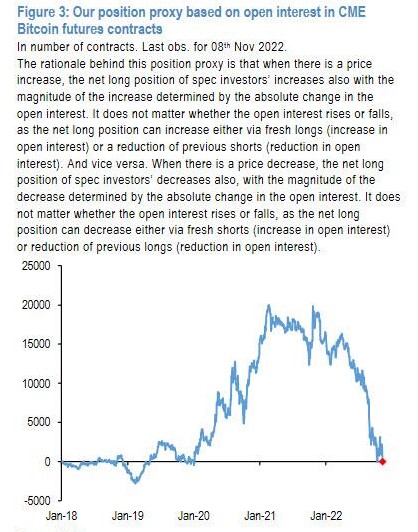

A J.P. Morgan strategist Nick Panigirtzoglou warned that given the size and interlinkages of FTX and Alameda Research with other entities of the crypto ecosystem it is likely we get a similar cascade of margin calls, deleveraging and company failures we got after the $20bn Terra USD collapse. Although he suggested deleveraging could take several weeks, He continued, however, on a positive note, stating that ‘the hit to crypto market cap is likely to be smaller than post Terra given previous deleveraging’. As the picture below suggests we’ve already gotten loads of it in 2022, especially after the Luna crash. It is clear that we’ve already come a long way down, which indicates there isn’t that much room left for further deleveraging.

Source: J.P. Morgan

How is the government going to react?

In a totally predictable manner the very second FTX halted withdrawals, the politicians started demanding more government intervention. For example, Chair of the House Financial Services Committee - Maxine Waters said that the fall of FTX highlights ‘the urgent need for legislation’. There is no doubt the government isn’t going to let a crisis go to waste and is going to put forward an even stricter regulatory framework. We can assume regulators will pressure crypto entities to disclose more information about their balance sheets, as well as prescribe more responsible risk management. They could go as far as trying to limit the counterparty risk among crypto market entities. On top of it, government agencies will probably try to implement restrictions on what centralised exchanges can do with their clients’ assets.

Are such measures something to be welcomed? This is a question that will get you vastly different results among different crypto supporters, because the community is heavily divided on the topic of regulation. Some investors argue that regulation is necessary to pave the way for further adoption, while others (primarily those that see crypto as a solution to government) see regulation as totally against the core idea behind Bitcoin and cryptocurrencies. Whether you subscribe to the first school of thought or the second, it is worth pointing out that Bernie Madoff was regulated by the SEC the entire time he ran his Ponzi scheme, which shows there is no guarantee regulations can prevent potential similar future scams in crypto.

Conclusion

The problem behind FTX implosion isn’t crypto, but rather how the centralised exchange used to operate. A day before they halted withdrawals SBF was assuring his followers (in a since deleted tweet) that FTX doesn't invest client assets, which turned out to be a blatant lie. He was a scammer and scammers are gonna fraud, whether it is in crypto, traditional finance, or anywhere else. Luckily, it looks like investors have recognized where the source of the problem lies. According to CryptoQuant, over 80,000 Bitcoins have left CEXes in the past few days, as investors look for safer options in the wake of lost confidence in centralised exchanges. Ironically this total failure of trust can be attributed to drawbacks of centralised systems that only crypto can fix.

Since crypto poses as the antidote to this poison, we remain rather optimistic when it comes to the long term outlook. We believe that this bear market is going to end eventually, just like every single one so far and once the market turns around those who will still be around will get rewarded.