CENTRALIZED EXCHANGES (CEX) VS DECENTRALIZED EXCHANGES (DEX)

Centralized exchanges have dominated the cryptocurrency trading arena for a while, but have their share of problems.

Infamous hacks over the years have drained users of their funds, and in some cases made the exchange insolvent and unable to continue business after a hack, such as Mt. Gox, Cryptopia, and even just recently Livecoin exchange in Russia. And let’s face it, many people are using centralized exchanges to store their decentralized cryptocurrencies.

In terms of hacks, that creates a honeypot for hackers to constantly attack an exchange because the prize for the hack is the cryptocurrency being held for all the exchange’s users. Cryptocurrency that is not being actively traded should be stored in a wallet where you control the private keys and not on a centralized exchange.

To learn more about why this is important, check out our recent blog about Proof of Keys day. Other issues with centralized exchanges are that they are pressured by regulatory bodies to be compliant with every country’s laws and regulations that their users reside in.

This causes strict KYC, or Know Your Customer policies. Exchanges take on the burden of not only collecting sensitive identity data from their users, but now are in charge of protecting that data as well. This also causes many exchanges to exclude certain countries from trading all or some of the trading pairs on said exchange.

So, you are limited depending on what side of a border, an imaginary line, that you are born on. This detracts from the premises of freedom that Bitcoin and other cryptocurrencies represent. Also, many centralized exchanges either have very high listing fees to list a coin or token, or they have strict guidelines that many projects just starting are not able to meet.

Enter decentralized exchanges

Decentralized exchanges allow a user to connect their wallet to exchanges and trade. Decentralized exchanges, also called DEX, are not relatively new, but also have had their share of issues.

In some cases, what was passed off as a decentralized exchange, still limits the access of customers depending on what countries they live in. And liquidity has been an issue as well. Without liquidity, it can be difficult to make trades as orders can go unfilled even though a certain order price is hit. Simply put, not enough people buying and selling a cryptocurrency on a decentralized exchange can lead to the inability to trade a crypto on that exchange.

User interfaces for these exchanges has also been an issue and led to the slow adoption of decentralized exchanges. There has been plenty of potential and hope in decentralized exchanges as they can protect users from issues in centralized exchanges such as the hacking mentioned above, along with mismanagement by those in charge. Enter Uniswap.

What is Uniswap?

Uniswap started in November 2018 with a tweet from creator, Hayden Adams announcing that Uniswap, a decentralized exchange for trading ERC20 tokens was live. Uniswap has since risen to a level of high popularity, utilized by many projects to launch their tokens on to make them available to trade and raise funds. As of recently, Uniswap is averaging close to $1 billion dollars per day in trading volume.

Any token can be listed on Uniswap by funding it with liquidity by adding an equivalent value of Eth and the ERC20 token being listed. What is unique about Uniswap is the price is not dedicated by buy and sell order, but instead by the relative amount of Eth and said token in the liquidity pool.

Uniswap balances out the value of the tokens based on how much people buy and sell them and how that impacts the liquidity pool. The more people buy, the amount of Eth in a pool goes up and the number of tokens go down, causing the price of the token to rise in value. There is no listing requirement or listing fee to list a token on Uniswap so beware of scam projects.

There are no KYC or country resident requirements for users to trade on Uniswap. Anyone can connect a Metamask web browser wallet, or on mobile a Trust wallet or similar that has a Web3.0 browser built into the wallet by using that browser to access the Uniswap website. This ease of listing a project’s token along with the ease of the user to trade tokens on Uniswap has created an ecosystem for projects to launch.

DEXES, DE-FI, UNISWAP...

Not all projects are legitimate so you will need to do your own research to ensure you are protecting yourself from those. The rise in the popularity and use of Uniswap throughout last year also led to the creation and launch of many DeFi, or Decentralized Finance projects, with many using Uniswap to launch and fund their projects. This ecosystem, while it has led to some projects that collapsed either due to faulty code or bad actors, has also spawned so many projects that have the potential to have positive global impacts, which can also include many of those around the world who are excluded from participating in current financial markets. We are still in the early days of DeFI, but it will be exciting to see all that develops from this.

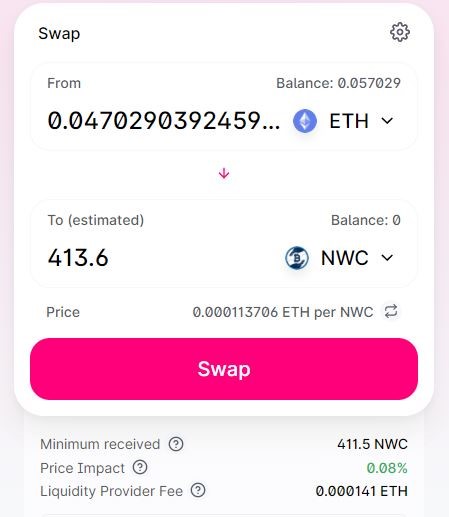

Uniswap is easy to use and can be accessed by anyone. From the web browser, you just need to visit https://uniswap.org/ and click Launch App to begin trading once your wallet is connected. Once in the app, you can simply select what trading pair you want to trade, for example, trading Eth for NWC tokens. You will then click SWAP and then approve the swap by paying the Eth gas fee. If the token you are looking for does not appear by searching name, you can copy and past contract address instead in drop down box of trading pairs. More details below.

You want to make sure you always select the right token to trade as there can be fraudulent tokens created to trick people. You always want to make sure you use the correct contract address, either obtained from the official announcement source of that project, or the verified contract address listed on Coingecko on the token listing page. For example, to trade NWC tokens on Uniswap, you can follow the instruction in the Uniswap guide recently published, https://newscrypto.io/blog/buy-nwc-uniswap.

Below is an example of how to obtain the correct contract address from Coingecko, using Link as an example(since NWC listing is still in the process of being updated).

WHY NWC ON UNISWAP

While NWC originated on the Stellar blockchain with low fees and fast transactions, allowing the ability to have tokens on multiple chains not only opens up NWC tokens to more traders and investors, but can allow users to participate in future developments which can now include the DeFi ecosystem on Uniswap, other decentralized exchanges, and the Ethereum ecosystem.

Future rollouts will allow users to swap NWC tokens between the Stellar, Ethereum, and Binance Smart Chain networks. Added utility in any token has the potential to increase the demand and in turn, the value of a token. Uniswap has proven that there is a high demand for a decentralized ecosystem where anyone can participate without any barriers to entry, for both the end user, or the project listing a token.

Several other decentralized protocols similar to Uniswap have since launched and the combined trading volume daily exceeds $1.5 billion between Uniswap and others. The total value locked in DeFi liquidity recently exceeded $18 billion dollars. And as you can imagine, we have only just begun to see the potential of this. Make sure to keep up with all the exciting updates of the NWC token in relation to Defi protocols!