Unfortunately, when asked about the reason behind Bitcoin’s creation, many people in the crypto community tell only half of the story. They tell you that it was created to allow people to send money over the internet in a decentralised manner. When you try to wire someone money in a traditional way - through bank transfer, banks have the ability to prevent you from doing so. The reason could be in the government (it could even lie in foreign government(s) - as in case with western countries’ sanctions on Russia), one of their countless regulations or in the bank itself. To add insult to injury, these financial intermediaries also charge fees that are sometimes anything but insignificant. But as already mentioned, this is only half of the story. For the other part, you have to go back to the beginnings of Bitcoin and its genesis block that serves as a reminder of the true purpose that lies behind Bitcoin creation.

So, what lies at the core of cryptocurrency invention?

‘The Times 03/Jan/2009 Chancellor on brink of second bailout for banks’. This is a quote that was encoded in the first block mined on the Bitcoin network. It unveils what motivated Satoshi Nakamoto to create the first cryptocurrency. It was government control over fiat currencies and their emission. While central banks that control money supply in the economy don’t have a cap on how much money they can create, they do have countless incentives to keep their ‘monetary’ pedal to the metal. On top of having to monetise massive government budget deficits they also have to conduct monetary policy, which essentially has only one solution for every problem and that is ‘money printing’.

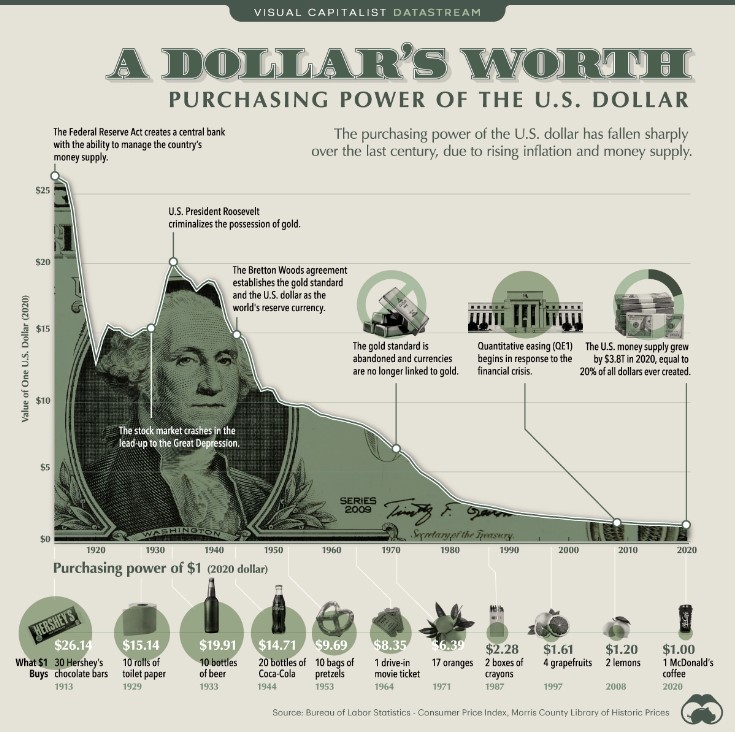

Just like every time it has faced a financial crisis since Keynesianism became predominant philosophy in economics, having faced the Great Financial Crisis, the Fed once again responded by lowering rates and flooding the economy with an unprecedented amount of freshly printed dollars. As expected, in order to be able to kick the can further down the road, central bankers had to come up with an even bigger stimulus package than ever before, bailing out banks and other financial institutions in the process. Having witnessed these destructive policies, Satoshi Nakamoto didn’t sit by, but rather introduced a currency that took the power away from politicians at the Fed (as well as other central banks) who are solely responsible for the astronomical depreciation of the dollar, which has lost 98% of it value in just past 50 years (note that the picture below is based on ‘official’ inflation numbers).

Can it get even worse than that?

Unfortunately, yes. Numerous central banks around the world (nearly 90% of world’s central banks) are planning to launch their own digital tokens, called Central Bank Digital Currency (CBDC). There are definitely quite a few technological advantages that come hand in hand with the adoption of blockchain technology (such as improved efficiency, accessibility and security on top of reduced transaction costs), but CBDCs come with a price tag (and the price surely isn’t cheap).

What is the drawback that comes with CBDCs?

A monetary system with digital fiat currencies further empowers central banks at the expense of your privacy. Not only CBDCs allow governments to track and control every dollar you earn, save and spend, but they are also a powerful tool that can be used to enact all sorts of policies that punish and reward people through smart contracts. For example, less than a year ago when lockdowns were still in place in most western countries, CBDCs could enable politicians to practically prevent people from leaving their homes. They could be programmed to prevent you from paying for products or services, if you were located too far from home. Similar actions could be taken against you for any pretext politicians found convenient.

The International Monetary Fund (IMF) openly said that CBDCs could allow a government to control what people spend their money on. ‘A CBDC can allow government agencies and private sector players to program, to create smart contracts, to allow targeted policy functions … for example, welfare payments, … , consumption coupons, …, food stamps … by programming CBDC, that money can be precisely targeted for what kind of people can own [CBDC] and for what kind of use this money can be utilized, for example for food.’ are the exact words Deputy Managing Director of IMF Bo Li used to describe how CDBCs allow the government to precisely target what people need, which will, according to him, ‘improve financial inclusion’.

Additionally CBDCs enable central banks to carry out even more reckless monetary policies. Since stimulating the economy to prevent (postpone) a financial crisis requires an ever increasing amount of stimulus, the Fed is slowly running out of options. For example, at the time of the Great financial crisis most conventional measures proved not to be effective anymore, so the Fed resorted to a totally new monetary policy tool called quantitative easing. A digital dollar would allow the Fed to impose deeply negative interest rates, by programming tokens with an expiration date. This would force people to spend, instead of hoarding their money, which would allegedly ‘boost’ the economy and prevent (postpone) the crisis.

Conclusion

While the blockchain technology backing such CDBCs could be the same as the one backing other digital currencies such as Bitcoin, the two are fundamentally totally different, just like DeFi and TradFi are different in much more than simply their respective tech stacks. CDBCs are centralised, so you need the government’s permission and blessing to use them, whereas Bitcoin is decentralised and therefore permissionless. On top of that, CDBCs give governments an insane amount of control over people and even the ability to micro-manage their lives. On the other hand, the government has no power over Bitcoin. Nor it has any power over its total supply, which is and will stay capped at 21 million.

Bitcoin opens the door for more freedom and justice, while CBDCs could pave the way for tyranny. Be careful what you choose!