A very significant thing happened last Wednesday (28th September). Since the markets have been hoping for the Fed pivot for so long that some investors even started to believe the ‘Fed put’ has expired, they've instantly lifted out of turmoil once confronted with reality that the pivot is indeed happening. Just not (yet) from the Fed, but the Bank of England. Whether you’re a crypto, stock or a bond investor, ramifications of BoE’s decision to basically reverse their monetary policy are remarkable.

Just days prior to the big event, the Bank of England was telling everybody how committed they are to fighting inflation. The next day BoE stepped in to prevent around 90% of UK pension funds, who are running defined benefit (DB) pension schemes, from getting their positions wiped out. Why such a dramatic turn in policy of BoE? Will other central banks also turn from ‘hawks’ to ‘doves’ right away, once the first sign of a crisis pops up? What does that mean for inflation? Read the blog until the end, to find out the answers to these questions and more!

Why did pension funds get into trouble in the first place?

As already mentioned, these pension funds were running defined benefit (DB) pension schemes. In essence, they were obliged to pay out the pensioners an amount of money (based on the number of years pensioners have been a member of the scheme and the amount of money they’ve paid in during that time) every month. Typically, pension funds operating these schemes have been investing more than half of their assets in bonds, because of their reputation of being a safe investment (the British government has never failed to make interest or principal payments on their government bonds called gilts), as well as due to its predictable stream of cash flows, as funds traditionally used income from their bond portfolios to pay their pension liabilities.

Since the Bank of England (just like pretty much every other central bank around the world) has been artificially suppressing interest rates to historically extremely low levels for almost two decades, yields on gilts have been artificially suppressed as well. While loose monetary policy has allowed the UK government to get deep into debt with practically zero costs, it created a massive problem for pension funds. How could they meet their payout obligations, if their bond investments had such low yields? It was easy while UK 10 year gilts were yielding about 5% (which was a reality less than 15 years ago), but has proven to be impossible once Bank of England (BoE) decided to lower rates practically to zero to deal with covid crisis.

In order to be able to meet their obligations to pensioners, a lot of British pension funds started using leverage (Pension funds used everything from equity options to credit default swaps, but let’s assume an oversimplified case, as it illustrates the point sufficiently). Instead of only buying bonds with money at their disposal, they borrowed extra money at a very low interest rate (much lower than the yields they were getting on a long term UK government bond) and bought more bonds, which helped them get sufficient income to cover their liabilities.

Although this may seem like a genius idea at the very first glance, there is a tremendous interest rate risk that comes with it. Why? If interest rates go up, their bond portfolios’ value collapses, while costs of servicing their short-term debt rises. Interestingly, this is precisely the problem pension funds in the UK which used short-term debt to buy long-term bonds, have been facing since BoE stepped on its interest rate hiking path, which caused bond yields to spike. Last week things got so bad that lots of these pension funds were starting to get margin calls on the money they’ve borrowed. Failing to get additional collateral (bonds have been losing value rapidly due to the massive sell-off in the bond market), would result in forced selling into an already depressed market. According to Peter Harrison, the CEO of Schorders, some ‘players in the market’ already ran out of collateral and started dumping Gilts. Clearly, further selling would cause a total bond market crash.

How did the Bank of England intervene?

In order to prevent a so-called ‘Lehman moment’ (named after the Lehman Brothers collapse in 2008), BoE decided not only to suspend their QT program, but also ‘temporarily’ pivot back to QE. By pledging to buy up to 5 billion pounds of long-term gilts for 13 weekdays, the Bank of England has essentially bailed out its pension funds. With creation of billions of pounds out of thin air and its injection into the economy, BoE propped up the UK government bond market by artificially increasing demand for gilts, which helped prevent ‘mass defaults’ of numerous UK pension funds.

How did the market react?

Gilt yields tumbled shortly after the intervention, along with US Treasury yields which followed suit. Looking at the picture below, we can see how the yield on a 10-year UK gilt slumped for around 50 bps (or 0.50%), having risen by roughly 100 bps in the days prior to the pivot.

In order to be able to meet their obligations to pensioners, a lot of British pension funds started using leverage (Pension funds used everything from equity options to credit default swaps, but let’s assume an oversimplified case, as it illustrates the point sufficiently). Instead of only buying bonds with money at their disposal, they borrowed extra money at a very low interest rate (much lower than the yields they were getting on a long term UK government bond) and bought more bonds, which helped them get sufficient income to cover their liabilities.

Photo #1: Yield on a 10-year UK gilt (Source: markets.ft.com)

Photo #1: Yield on a 10-year UK gilt (Source: markets.ft.com)

Crypto, stocks and gold rallied on the day, as investors warmly welcomed the first central bank to openly put markets before the inflation fight (with the exception of Japan where BoJ keeps yields on 10-year JGBs artificially surpassed through their indefinite QE program). Accordingly, even the British pound rose 1.4% against the dollar on the day (Dollar index plunged on the news) in spite of BoE’s ‘dovish’ action, as investors expect the Fed to also pivot sooner than previously expected.

Photo #2: BTC, Gold and SPX spiked following the news

Photo #2: BTC, Gold and SPX spiked following the newsCould pension funds prevent the problem themselves?

Exceptionally low interest rates have basically pushed pension funds into the corner. Theoretically they could have solved the problem by reducing payouts, but choosing the ‘leveraged’ way was actually a no-brainer. Why? Because all of the government interventionism has created a huge moral hazard. Pension funds deciding to reduce payouts, would result in a loss of customers. Contrarily, buying more bonds with leverage, despite the increased risk, doesn’t really come with any negative consequences. While on the surface it looks like pension funds were caught between a rock and a hard place, in reality they were actually facing what seemed like a win-win situation.

The Bailout act in 2008 and all of the following company rescues of a smaller degree carried out by the government, have assured market participants that central banks are ready to save them, if the problem they create is big enough to pose a systemic risk. Consequently these pension funds would be foolish if they took a less risky option, which would only ensure a loss of customers to other competitors, betting on the central bank to bail them out. Contrarily, deciding to proceed with a more risky investing strategy secured higher earnings (and consequently higher rewards for the management), along with potential help from the government and central bank in case things didn’t go according to plan.

Conclusion

The fact of the matter is that BoE reversed its policy from tight to loose, by abolishing QT plans and going back to QE. Although they’re trying to defend their action by claiming it is only temporary and a part of ‘systemic risk management’ used to prevent a crisis, the justification should be taken with a grain of salt. Back in 1984, Milton Friedman already observed that ‘Nothing is so permanent as a temporary government program’ and the following 40 years have only further proven his claim.

Even if one isn’t critical of BoE’s action and believes it was justified, there is no way to believe no similar ‘emergencies’ will occur in the near future. Almost two decades of reckless monetary policy have taken its toll on developed economies, which include the US and Europe. Artificially low interest rates have promoted excessive debt and risk-taking. Lots of business models and companies seemed viable when rates were at zero. How many of them are going to be viable once the interest rate hits three or even four percent? Probably a lot less than now. This means that sooner rather than later central banks are going to have to resort to stimulative policy to try to prevent a crisis. Unfortunately, to get the desired effect, they’ll have to step in with ever increasing amounts of money.

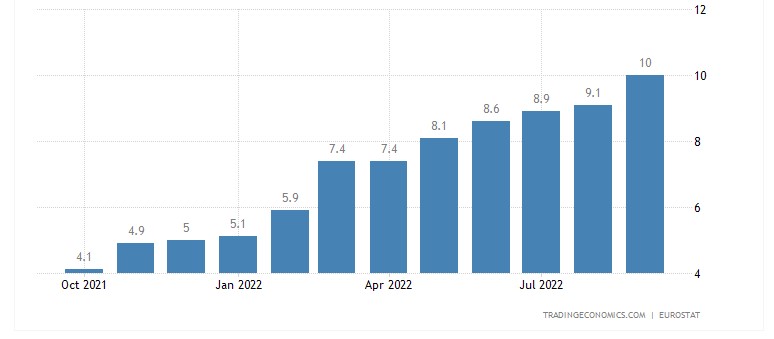

This implies that the inflation is not only here to stay, but will get much worse. There are numerous other factors pointing towards the same dire outcome. Everything from money velocity starting to pick up, to producers eating up their price increases, not passing them to the final consumer. Meanwhile Europe already has double-digit inflation, while the CPI in the US is currently at 8.3% year-over-year (keep in mind that these are official numbers and that the real increase in the cost of living is probably two times greater than the official number suggests).

Photo #3: Annual inflation rate in Euro Area (Source: tradingeconomics.com)

Photo #3: Annual inflation rate in Euro Area (Source: tradingeconomics.com)Throughout the whole Fed tightening cycle, both gold and its digital counterpart have dropped based on a belief that the Fed will vanquish inflation. Historically, the price of all assets (except cash - USD) tends to go down when the Fed is fighting inflation, therefore investors were reluctant to ‘fight the Fed’. Once the Fed openly changes course, investors will change their strategy. Instead of betting on the Fed to take care of inflation, they’ll try to preserve their purchasing power by hedging against inflation by buying tangible assets (physical gold, real estate, …) or digital assets (Bitcoin and other cryptos). At that time we could see a massive reversal in prices of these assets.

When will the Fed pivot? Nobody knows for sure, but as we’ve seen with the Bank of England, monetary policy can completely reverse overnight.