After more than three weeks since the FTX drama began, we are sure that everyone in the crypto industry is familiar with how things turned out (FTX bankruptcy). In case you’ve been living under a rock, we’ve got you covered as always. We’ve also written an article that covers reasons why the recent meltdown of FTX has sent shock waves throughout the crypto industry and put forward potential consequences that could come about as a result of the FTX crisis.

There is no doubt that FTX bankruptcy came out of the blue for the majority of crypto investors. As a result countless investors that didn’t take warning signs seriously lost access to their life savings (or at least a portion of it). Lots of people that got affected by this crisis probably held a (too) big chunk of their crypto holdings (if not everything) on the FTX exchange. If they haven’t withdrawn their funds from FTX before the exchange halted withdrawals, there is a high probability they will never get in control of their digital assets again.

On a more positive note, many investors got away with minimal losses in the form of a decline in value of their crypto holdings, which came as a result of spill-over from the FTX drama into the broader market. Coming to a realisation that crypto investors were disproportionately affected by the FTX collapse led us to believe that there must be some valuable lessons we can learn from this meltdown. Let’s dive into 4 lessons for crypto investors.

Nobody Is Too Big To Fail

Before collapsing, FTX was the second biggest crypto exchange in the world, so it is no wonder its bankruptcy sent shockwaves throughout the whole crypto industry. The collapse serves as a wake-up call that no company is too big to fail. It is especially important to keep that in mind when putting your money in digital assets, as crypto is still a wild west compared to the traditional financial world when it comes to regulation. For example, in the midst of the financial crisis of 2007–2008, when numerous banks ran into liquidity problems, the government injected capital into banks and other financial institutions in order to stabilise the economy and keep financial markets running.

In crypto there are no such bailouts, which isn’t necessarily a bad thing, it just means that you need to do your due diligence, if you want to escape the government’s involvement. Simply put, just like you need to do your own research (DYOR) when conducting analysis of a project you want to invest in, you need to evaluate how fundamentally sound a centralised exchange is before depositing your hard earned money into their custody.

Not Your Keys Not Your Crypto

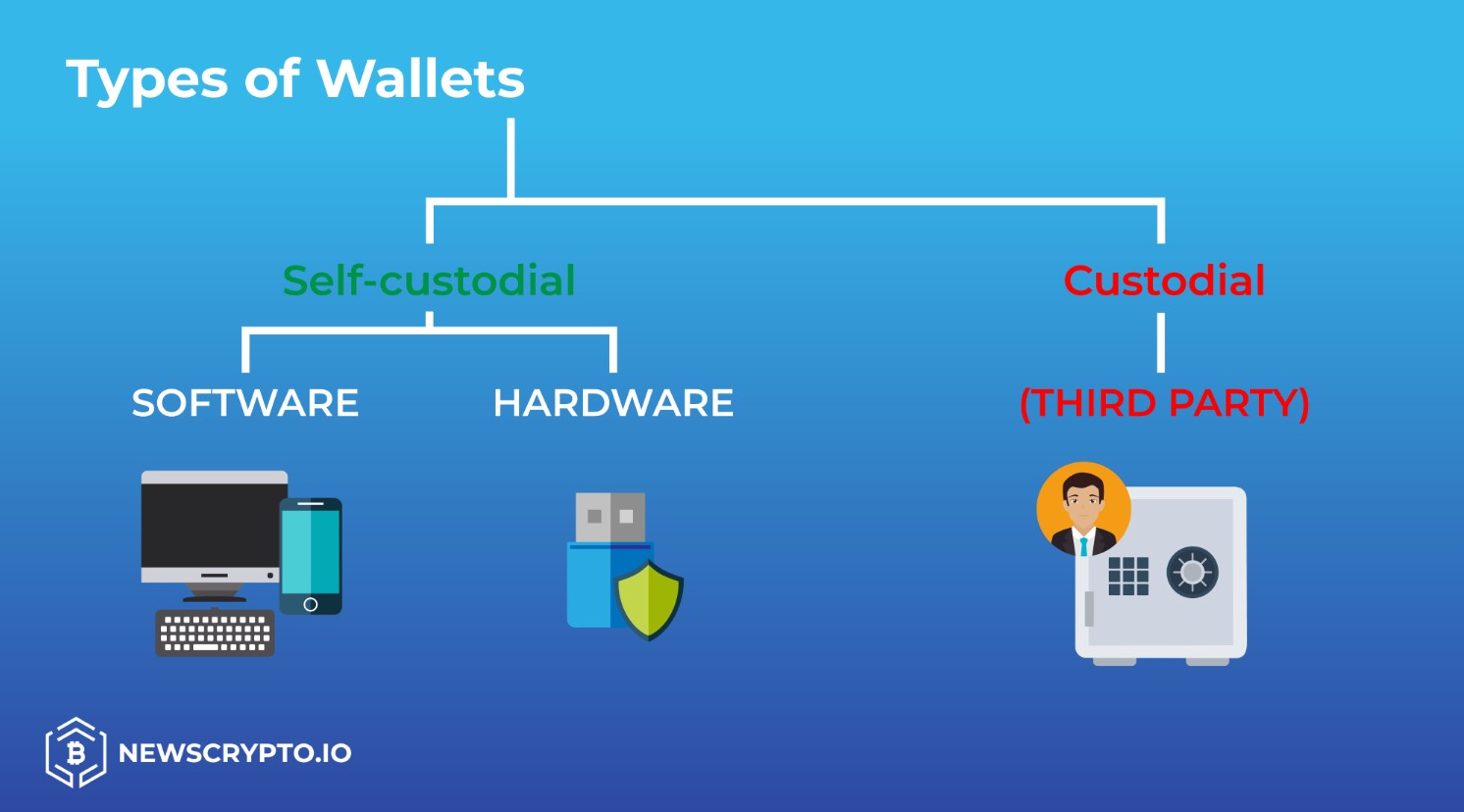

Here at NewsCrypto, we’ve warned countless times that you aren’t really in charge of your crypto, unless you’re also in charge of your private keys. While a custodial wallet might seem like a more convenient option (tokens you buy on centralised exchanges are automatically stored in a custodial wallet they control) because it lessens your personal responsibility (since you don’t have to store your own private keys), it requires trust in the third party.

Source: NewsCrypto Academy

There are numerous wallets that differ in convenience and safety. Usually the safer the wallet, the less convenient and vice versa. Your job as an investor is to strike the right balance between functionality and security, which can most easily be achieved by using a combination of two or more different types of wallets. It’s advised to keep bigger amounts of coins or amounts that you’re willing to hold long-term in self-custodial storage while having smaller amounts of coins that you want to trade frequently stored in a custodial wallet so it’s easily accessible when you want to enter or exit positions. On top of it, the amount you keep on centralised exchanges should be limited to what you’re comfortable with losing, since these funds are never really safe because of third party risk.

Not Everything In Crypto Is Decentralized

As just outlined with a comparison of custodial and self-custodial wallets, although many people consider crypto to be fully decentralized, the reality is a little bit more complicated, as there is a whole spectrum of (de)centralization in crypto. On one side there are centralized exchanges (CEXes) that operate pretty much like traditional banks and are completely centralized (just like FTX). On the other side of the spectrum there are decentralized exchanges (DEXes), DAOs and protocols like Bitcoin that run entirely in a decentralized manner. Consequently, you need to evaluate the risk accordingly when dealing with either centralized exchanges or any other protocol that operates in a completely centralised fashion.

Diversification Is The Key

As the golden rule of long-term investing ‘don't keep all your eggs in one basket’ teaches, whether you’re investing in stocks, cryptocurrency or any other asset, you always need to spread your investments around to mitigate risk. When it comes to crypto it basically means you should not invest all your holdings into one single cryptocurrency, but into a variety of them. For example, people that held a huge portion of their holdings in FTT (FTX token), were disproportionately harmed by the FTX implosion, as the token lost about 90% of its value in a matter of days (just like crypto investors with too much exposure to LUNA and UST were affected disproportionately back in July, when Terra Luna and algorithmic stablecoin UST imploded).

Source: TradingView