Weekly Crypto Recap w/ NewsCrypto

Welcome back, NewsCrypto enthusiasts! It's time for another edition of the NewsCrypto newsletter.

Today we are presenting you a plan for Bitcoin for the next couple of weeks and what's up with the Bitcoin spot ETFs and how they are noticeably affecting the price of Bitcoin.

Institutions are feeling pre-rich and so are a lot of people.

What's on the menu today?

1. Breaking Crypto News

2. Crypto Fear and Greed Index

3. BTC TA Analysis

4. Wall Street is Accumulating Bitcoin Like Crazy!

5. Funniest Meme of the Week

News Recap

· There are rumours that Jeff Bezos was selling his shares of Amazon to buy Bitcoin, he also met with Michael Saylor.

· Hungary considers allowing banks to offer Bitcoin and crypto services.

· BlackRock Bitcoin ETF overtakes the largest Silver fund with over $10 billion in AUM.

· UK authorities have approved legislation enabling them to legally confiscate Bitcoin.

· Vanguard's CEO is retiring. Is this happening because they are going to offer Bitcoin ETF?

Would you like to read more about each piece of News?

Check out the News Section on our educational platform here 👇🏼

https://app.newscrypto.io/news

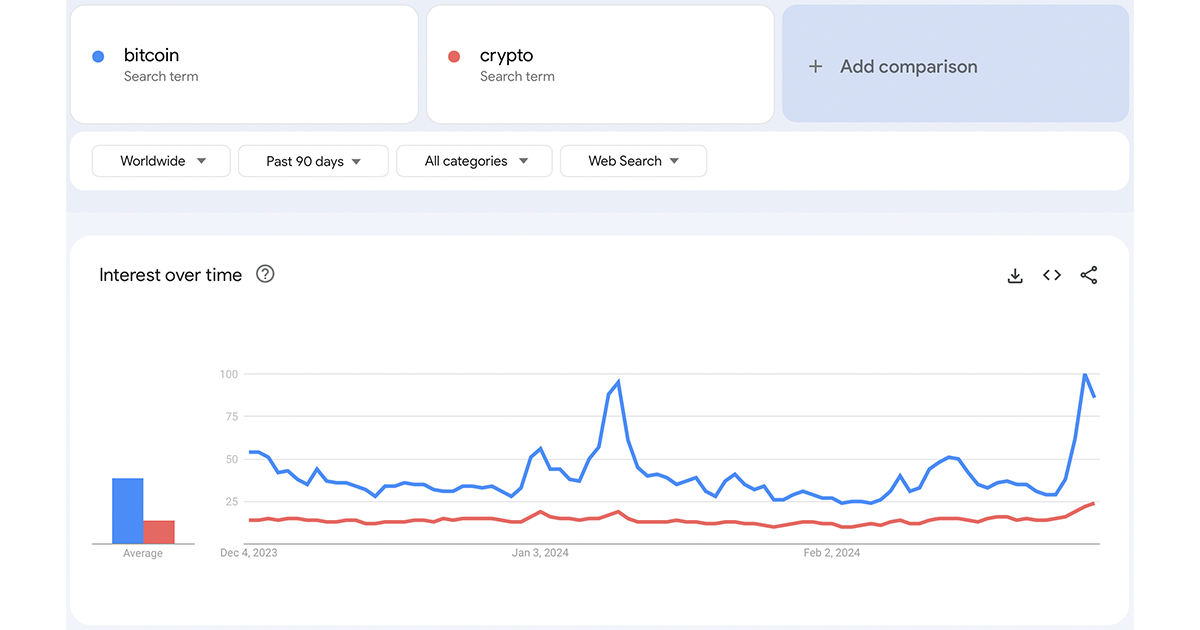

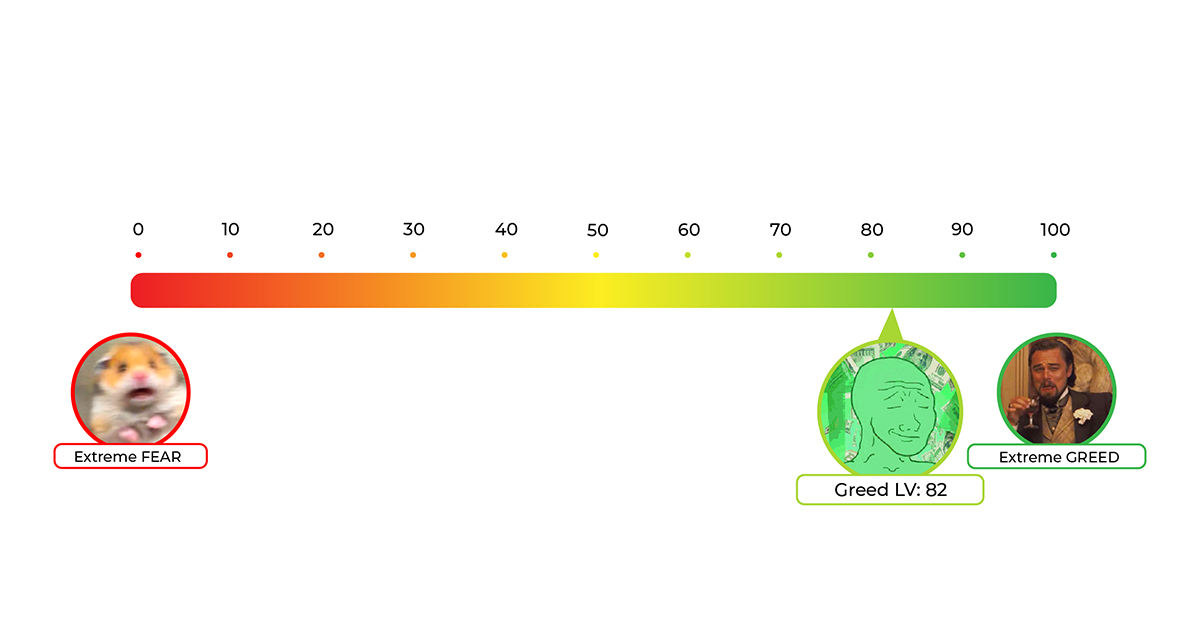

Crypto Fear and Greed Index

Bitcoin TA Analysis

Bitcoin Weekly Time Frame

The weekly chart looks like there is no stopping in sight. At the time of writing Bitcoin is fighting with resistance before the ATH. After it breaks above ≈$66k we are set to tag the ATH or even make a new ATH.

Now let's look at what the 4h chart looks like.

Bitcoin 4h Time Frame

On a 4h time frame Bitcoin was printing a bullish symmetrical triangle before it broke out to the upside. Always trade the trend and do not try to time the top because you will lose many times before successfully pulling it off and even when you do, it won't cover the losses.

At the time of writing Bitcoin is fighting with a strong resistance. The next stop is ATH of $69k. After reaching it pay attention to the charts or just our newsletter to find out if this is the top until the halving or if are we ready to make history and go above ATH before the halving.

Wall Street is Accumulating Bitcoin Like Crazy!

The US now has ownership of a significant portion of the Bitcoin treasure chest, with spot funds holding a staggering 776,464 BTC, valued at a sum of $47.7 billion. It represents a significant chunk of the 19.64 million BTC that are currently in circulation.

The Leaders of Industry

Leading the fleet is Grayscale’s Bitcoin Trust (GBTC). Since its launch, GBTC has been a formidable force, holding almost 3.2% of all Bitcoin on the market. However, since ETF approvals, GBTC has seen a slight decrease in its share, now holding 2.2%. This change came as GBTC transformed into an ETF, allowing shareholders to redeem their shares for Bitcoin, a move that has seen some of its treasure flow to new competitors.

New Challengers on the Horizon

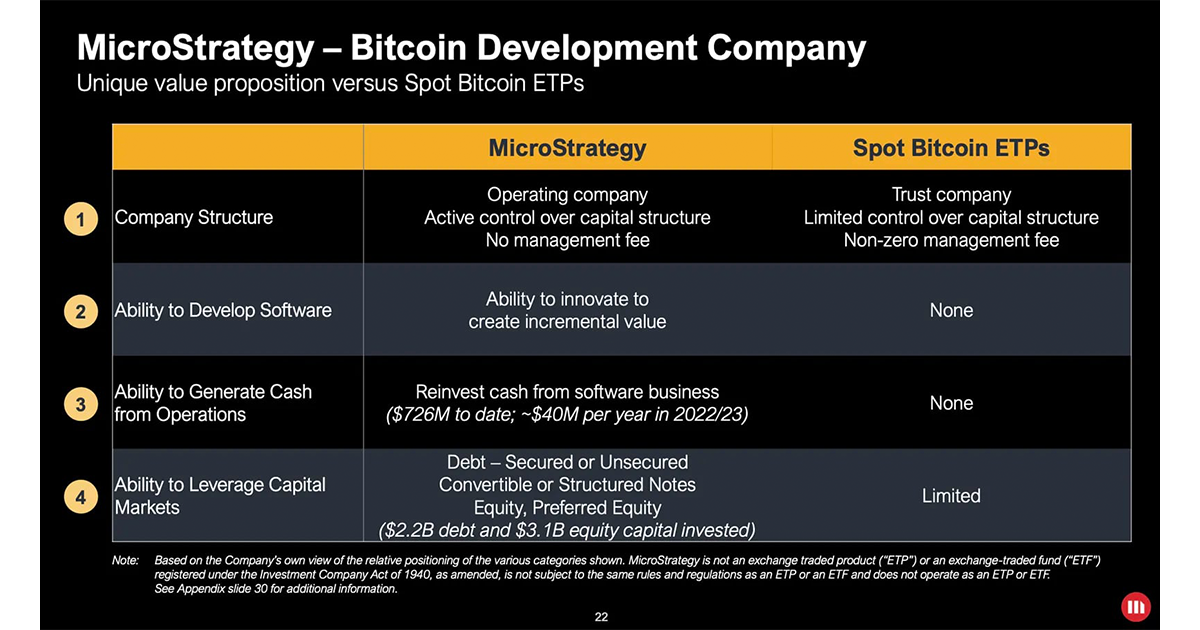

As GBTC is adjusting, other ETFs have swiftly entered the octagon, attracting fresh capital and compensating for GBTC's outflow. Among these new challengers, MicroStrategy stands as a strong ETF alternative, holding 0.98% of the Bitcoin supply. Under the command of the Bitcoin bull Michael Saylor, MicroStrategy's strategy has proven lucrative, sitting on ≈$5 billion of profits.

US Government's $BTC Stash

Not to be overlooked, the US government itself holds quite a big bag of Bitcoin, estimated at 215,000 BTC. These digital assets, seized in various criminal cases, add another layer of intrigue to the tale of Bitcoin's distribution.

The Lost and the Found

Amidst the accumulation and redistribution, a portion of Bitcoin's supply remains shrouded in mystery. Addresses tied to the enigmatic creator, Satoshi Nakamoto, contain between 600,000 to 1.1 million BTC. Additionally, a study by Chainalysis suggests that 3.7 million BTC could be lost forever, casting a shadow over 19% of the supply that may never see the light of day again.

The Spoils of the ETFs

Spot ETF shareholders find themselves well up on their investments, thanks to Bitcoin's robust rally. With $15.9 billion flowing into US-listed spot ETFs, these institutions have unrealized gains of over $4.7 billion.

Funniest Meme of the Week