Weekly Crypto Recap w/ NewsCrypto

Welcome back, NewsCrypto enthusiasts! It's time for another edition of the NewsCrypto newsletter.

Today we are going to talk about what halving means for the prices of cryptocurrencies as well as what has happened with Bitcoin since last week's technical analysis update.

What's on the menu today?

1. Breaking Crypto News

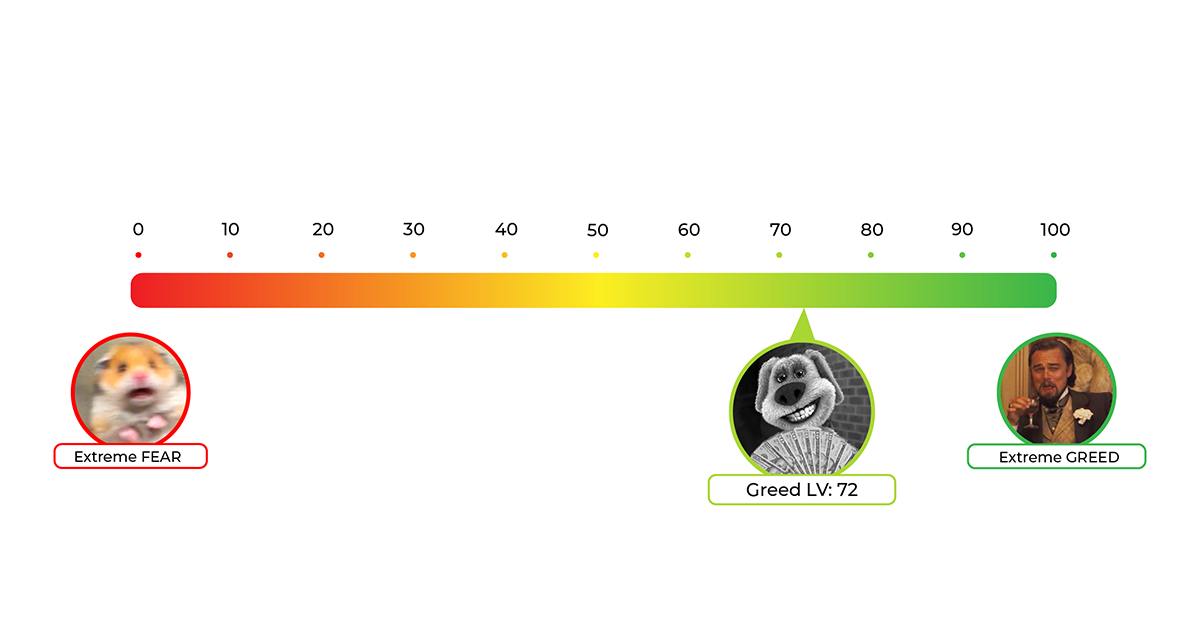

2. Crypto Fear and Greed Index

3. BTC TA Analysis

4. How Will Halving Affect Crypto Prices?

5. Funniest Meme of the Week

Breaking Crypto News

· MetaMask user count increased 55% in 4 months - anticipation is building for crypto

· Texas crypto firm is suing the SEC, accusing it of overstepping its bounds

· Trump is not a Bitcoin skeptic anymore but calls for more regulation.

· Court approved FTX's sale of Anthropic shares, adding $1 billion to the cash stack that will be used to repay creditors

· Reddit converts excess cash into Bitcoin and Ethereum

Would you like to read more about each piece of News?

Check out the News section on our educational platform here 👇🏼

https://app.newscrypto.io/news

Crypto Fear And Green Index

Bitcoin TA Analysis

1. Bitcoin Daily Time Frame

Not a lot has changed since the last week at least not on the higher time frame. Bitcoin is still ranging and holding above $50.5k.

Let's zoom in and analyze the 4h chart.

Here we can see that Bitcoin is ranging and forming a bullish flag which more often than not breaks to the upside. If this happens the target would be between $55k and $60k depending on what you count as a flag pole. You can either take the whole move from below the fair value gap or just the recent move up from around $48k as a flag pole.

At the time of writing $BTC also found support above 50MA on a 4h time frame. It's important to keep in mind it's a 4h TF because MA is much weaker as support/resistance on lower TFs.

This may be the bottom but Bitcoin can also continue ranging and this way force the impatient people to capitulate.

How Will Halving Affect Crypto Prices?

Every four years, the crypto community eagerly waits for an event that has historically sent prices of cryptos higher. This year the block rewards are set to halve from 6.25 to 3.215 bitcoin.

Looking Back

Past halvings have been nothing short of a rocket ride. After the 2012 halving, Bitcoin soared to $1,000, and in 2016, it reached a then-staggering $20,000. The latest halving in 2020 was a prelude to Bitcoin's all-time high of $69,000. The price surge didn't happen overnight, it required a lot of patience.

The Crystal Ball of Crypto

As we stand at the precipice of the fourth halving, the crystal balls of CT are out in full force. Some predict a peak of $77,000 by the end of 2024, fueled by institutional interest and the elusive spot ETFs making Bitcoin more accessible than ever before. But as we've learned many times crypto market is volatile and unpredictable.

What's Different This Time?

This halving comes with a twist – the recent approval of spot Bitcoin ETFs, making it the first halving packed with institutional interest. The influx of TradFi players through Bitcoin ETFs, coupled with the halving, paints a bullish picture. Maybe more bullish than ever.